Image: Hodlonaut, 2019 by Trevor Jones

Not your keys, not your coins. It may sound harsh, but if you don’t take self-custody of your Bitcoin, you can not be sure that it is truly yours.

This is a paradigm shift in private property rights, and those that understand it and take the time to learn best practices will significantly benefit from not having to trust third parties when it comes to storing their wealth.

Without self-custody, you just have a claim or a “promise” that you can access your Bitcoin when desired. Centuries of capital mismanagement and confiscation in the realm of money have taught us that if there is a central point of failure, i.e. a government or bank, it will eventually be exploited, and people’s money will be taken from them.

Bitcoin is different

At its inception, Bitcoin was the idea that a decentralized and digital store of value with a fixed supply could bring wealth preservation to the people. With a market price of zero at its genesis, to today being worth tens of thousands of dollars per Bitcoin, it’s safe to say people all over the world have come to truly value this new form of money.

Taking responsibility for one’s wealth with Bitcoin can add immeasurable benefits to their lives. In turn, they can learn to take responsibility for more aspects of their lives and no longer rely so heavily on the paternal state or outside entities for direction. Prosperity and ingenuity emanate from this person who has a moral compass built upon a strong foundation of self-sufficiency. Governments are then required to show proof of concept and work before they arbitrarily tax and leech off citizens. They can’t print more Bitcoin to fund the enrichment of a corrupt system.

It all starts with people becoming responsible for managing their time and energy and choosing what they accept in return for it. It’s no wonder that many people worldwide are using Bitcoin, and its incorruptible sound money properties, to lower their time preference and change their lives for the better.

Trust yourself to hold your money

With this revolutionary new asset also comes new concepts, considerations and risks around owning it. With Bitcoin, the onus is on you to keep it safe and secure. As Uncle Ben from Spiderman said: “With great power comes great responsibility”. This is a tradeoff you make when opting into this new system.

Much like days of old when one would keep their savings in gold coins, you can self-custody your Bitcoin today. The difference is that gold is clunky, not easily divisible, and costly when verifying its purity. If you buy gold and have a third party hold it for you, you trust that they will not mismanage it.

Bitcoin is instantly divisible. It is easy to verify its authenticity on its public ledger, called the blockchain, and it’s highly liquid, meaning you can buy and sell in real-time, 24 hours a day, seven days a week.

When you take self custody of your Bitcoin, you are responsible for managing it. Bitcoin transactions are final and can not be rolled back. There is a risk that you could lose your Bitcoin forever if you lose your hot wallet or cold storage key information (private key or seed words) or send your Bitcoin to the wrong address. On the other hand, if you decide to leave your Bitcoin on an exchange or outsource custody to a third party, you run the risk of the exchange being hacked or having your Bitcoin seized by an oppressive government regime.

Have no fear, help is here

Thankfully, safe and effective risk-management tools have been developed since Bitcoin’s inception. When you buy Bitcoin with AmberApp, your Bitcoin is secured with best in class multi-signature key management (multiple keys, spread internationally, required to open the vault) and your account is protected by two-factor authentication. A prudent next step would be to buy a hardware wallet, and once you set it up, practice sending small amounts of Bitcoin to it. There are excellent resources and informational guides on the best products and detailed guides on best practices at Jameson Lopp’s website Lopp.net. You can also find YouTube tutorials and blogs about best practices from Ben at BTC Sessions. Always verify any information you get from an online source. Ask around with reputable Bitcoin companies and advocates in the space. You are sure to find sound advice if you do your research diligently.

Collaborative-custody has also become a popular solution to help mitigate risks. In this security setup, you are working with a third-party company that will help you manage your custody configuration while ultimately retaining ownership. The high-level concept is you still have complete control over your Bitcoin, but safeguards are set in place to help assure that you don’t lose your Bitcoin unintentionally. Unchained Capital is a great Bitcoin-only companies that offer collaborative-custody solutions.

Risk goes both ways

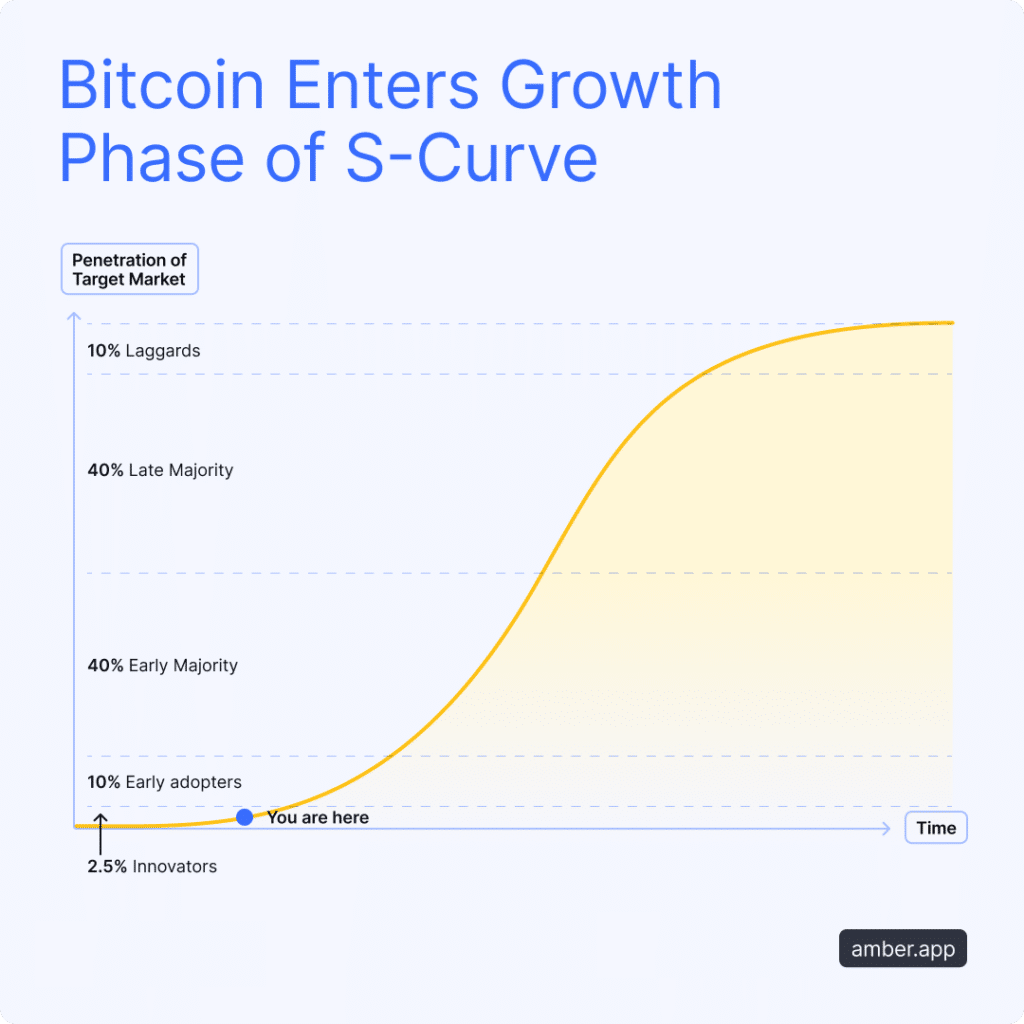

When considering the risks inherent with Bitcoin, it may also be important to think about the risks associated with NOT choosing to invest. Bitcoin’s adoption is rising at a rapid rate. New technologies that rapidly expand their user base tend to follow an s-curve of adoption.

The opportunity cost of not investing in Bitcoin could mean missing out on owning a piece of the finite supply of the world’s preferred store of value. Imagine if 20 years ago, you were able to invest in today’s largest internet companies. Except Bitcoin’s TAM (total addressable market) is all the value currently being stored in bonds, real estate, gold, and collectibles.

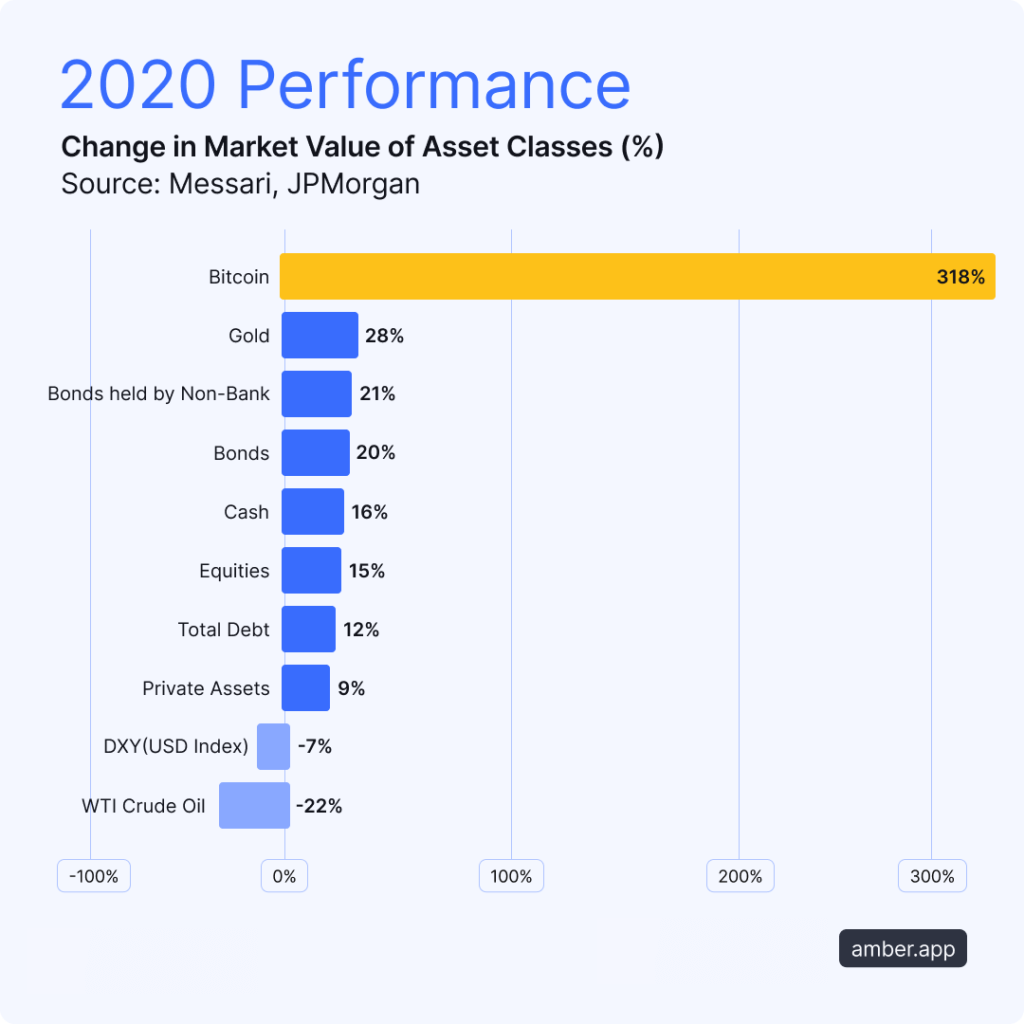

Over the past year, Bitcoin’s price has risen dramatically while other assets have barely kept up with inflation due to excessive money printing from central banks and governments worldwide.

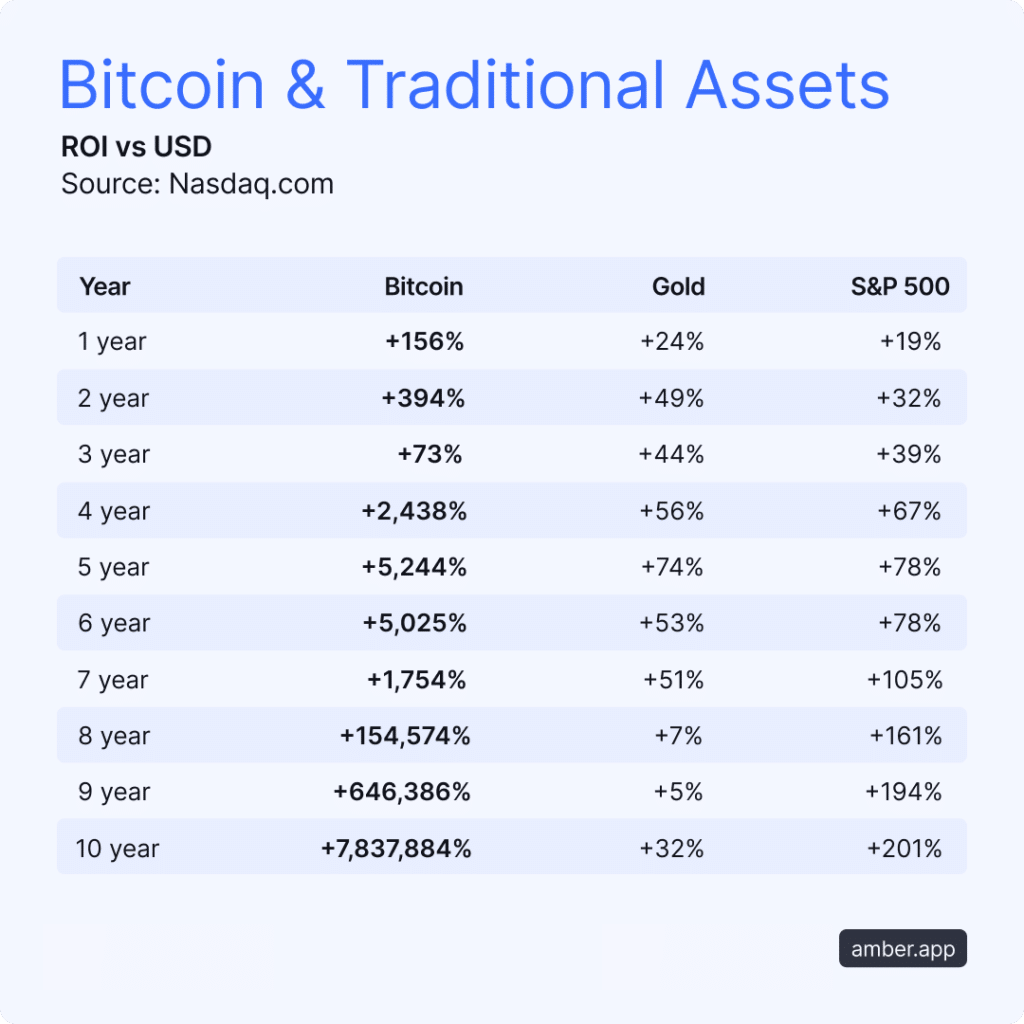

If we zoom out over the past 10 years, nothing has come close to capturing the wealth transfer generated by widespread Bitcoin adoption.

If we couple these statistics with the fact that institutions have begun buying Bitcoin to hold in their treasuries. El Salvador has recently declared Bitcoin legal tender within its borders; the only plausible conclusion is that Bitcoin adoption is scaling rapidly.

If you are still sceptical, you can start slow. As long as you aren’t investing all of your money in Bitcoin at this stage, you can mitigate your risks by ensuring that you have cash leftover to address your regular expenses or any emergency that may arise. Dollar Cost Averaging with AmberApp’s DCA recurring buys is a great place to start. Use AmberApp’s DCA calculator to get a gist of how this would work.

Bitcoin only – and here’s why

It’s worth looking at why AmberApp is Bitcoin-only. There are approximately 12,000 other cryptocurrencies that have launched since Bitcoin’s inception, and unfortunately, most of them are, at best, efforts to hop on a trend. At worst, they are outright scams that will eventually lose all value.

Most of these projects are launched by foundations, with venture capital backing and marketing teams behind them. They regularly start with a pre-mine, meaning a fixed portion of the supply of the token is given to investors before the broader public has access. Investors routinely dump their shares on unsuspecting retail participants once the tokens or coins are listed on exchanges and the price rises. Not a single cryptocurrency of size is sufficiently secure or decentralized in the way that Bitcoin is, nor do they have supply constraints, like Bitcoin’s 21 million cap.

Many claim that they exist for various use cases, yet they are unproven and most likely violate US Securities law. Exchanges are incentivized to list these tokens/coins and promote them because they make loads of money when people trade in and out of them. On the other hand, Bitcoin did not have a pre-mine.

With Bitcoin, there’s no marketing team; it has grown from the ground up.

Decentralization and censorship resistance are important

Bitcoin was discovered as a solution to centralized human intervention. Bitcoin is decentralized because voluntary node operators worldwide verify and enforce the rules. With most of these other projects, censorship is possible. Founders and developers can alter the code and re-organize the information, changing the history of the transactions. With most of these other projects, censorship is possible.

Bitcoin offers the advantage of not having to trust what information and transactions the network and blockchain are broadcasting – you can verify it yourself. You can operate your own node and further participate in securing the network. Check out instructional videos from Ben at BTC Sessions for how-to guides. Arman The Parman also has excellent guides available for free. Many other great resources are available to educate you about how to do this, and it is relatively cheap to spin up a node – $300/400 at most!

Do your own research

All in all, it’s important that you also do your research when it comes to investing in this new world of digitally native value. When it comes to investing in Bitcoin, you can rest assured that Bitcoin-only companies like AmberApp will have your best interests at heart when keeping you informed and educated about your decisions. Learning to take control of your financial freedom with Bitcoin is a process that yields amazing advantages for anyone who ventures to leap the rabbit hole. Before long, the rest of the world will follow suit.

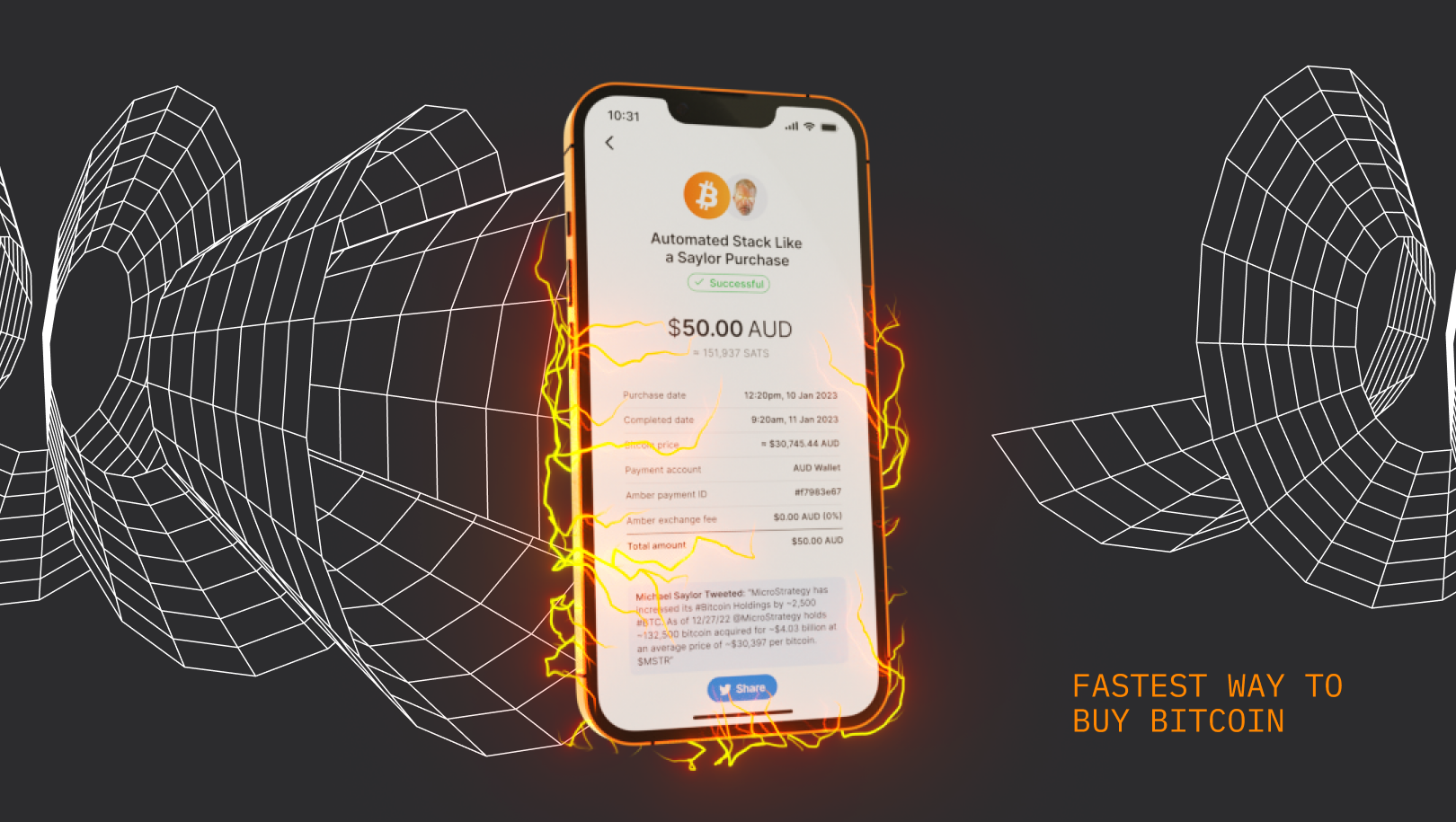

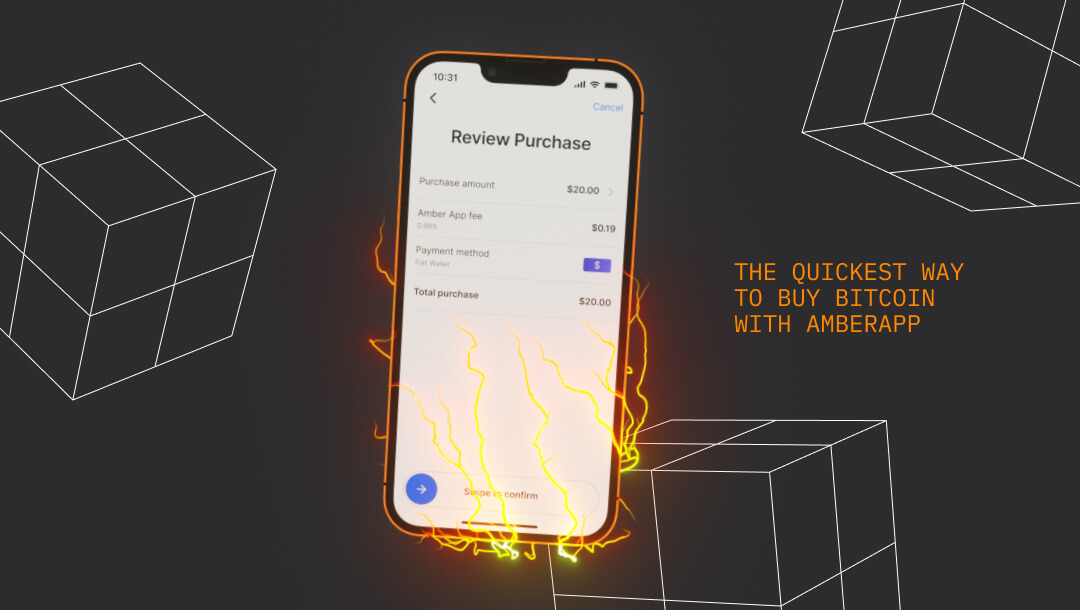

If you’re ready to dive in, you can make your first Bitcoin purchase in under 90 seconds with AmberApp.