₿itcoin is volatile, so they say.

But, is it?

Sceptics, no-coiners, even pre-coiners alike love to unimaginatively point this out time and time again, especially during downtrends. So, is Bitcoin really too volatile?

Typically, questions posed around Bitcoin’s volatility will receive a wide range of answers, such as:

- Bitcoin’s media hype drives volatility.

- Bitcoin’s lack of government regulation drives volatility.

- Bitcoin’s whales drive volatility.

- Bitcoin’s buyers’ speculation drives volatility.

While none of these points are inherently wrong, it seems those who claim such things hold a narrow view about volatility.

Despite being an online crypto casino full of shitcoins, Coinbase gives a pretty solid definition:

Volatility is a measure of how much the price of an asset has moved up or down over time. Generally, the more volatile an asset is, the riskier it is considered to be as an investment — and the more potential it has to offer either higher returns (or higher losses) over shorter periods of time than comparatively less volatile assets.

Coinbase

There are three main points to take away from this definition, risk, time, and price.

With this in mind, let’s dive in to answer the question, is Bitcoin really too volatile?

Risk

People tend to associate volatility with risk. Generally speaking, the higher the volatility, the riskier the investment.

Humans appear to love a bit of risk, every now and then. Around half of the Australian population is estimated to gamble every year. And in the US, 85% of adults have gambled at least once in their lives; 60% in the past year.

In the world of crypto, shitcoin enthusiasts get a huge dopamine hit whenever their token explodes 500% or more in 24 hours (or collapsing to zero soon after). This is a perfect example of volatility in action.

Anyone who looks into shares, bonds, or any form of crypto-currency must understand the risks associated with their investment. A strategy may be to look at the volatility of the respective asset to decide whether or not it is a sound investment.

Don’t invest in Bitcoin, it’s too volatile!

Literally anyone who has spent less than an hour trying to understand Bitcoin.

Deciding whether or not to buy Bitcoin isn’t any different. First, you must address and understand the real risks of converting your dollars into Bitcoin. Thankfully, it has been acknowledged time and time again that the risk of not buying Bitcoin is higher than simply saving in Bitcoin. Especially with the depreciation of fiat currencies around the world.

That’s why Bitcoin was the best performing asset of the last decade, by over 10x.

Greg Foss has had over 30 years trading risk and even he can’t get over how good of an opportunity Bitcoin is:

“If you are not long Bitcoin, you’re exposed to an incredible short position on what could be the best performing asset of this century”.

Greg Foss.

Foss uses, what he calls, “basic mathematics” to decide whether or not he should invest in an asset, when assessing risk. The flowchart below shows how Foss’ basic maths can be applied to buying Bitcoin:

Foss paid no attention to the volatility of Bitcoin when analysing the risk, and neither should you. Foss created a simple formula that makes the target price of Bitcoin ever elusive. Bitcoin’s volatility is only what the market is willing to buy and sell the asset for.

If you understand the fundamentals of Bitcoin and the problems that it solves, then any volatility correlated to risk becomes largely irrelevant.

Now, let’s address the topic of time.

Time

Bitcoiners love to talk time preference.

Time preference is simply how much value you place on the future over the present. It’s a daily debate experienced by all of us. Indulge in dessert, over eat, and perhaps feel sick, or exert some self control and stop. There are some remarkable similarities between time preference and people’s experience with buying shitcoins.

If you want to understand the importance of time preference, read The Bitcoin Standard by Saifedean Ammous, where he uses the concept to great effect.

Volatility is a measure of price over time. Thus, time has everything to do with volatility, as per the definition above. As you change the timeline on something, you are almost guaranteed to change the volatility.

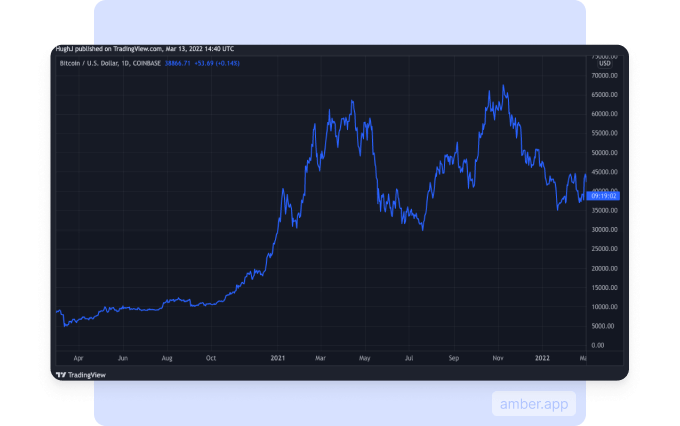

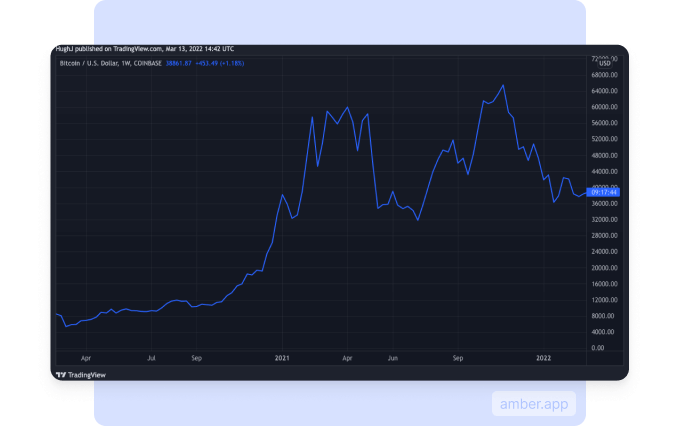

Compared to…

As you can tell by the charts above, volatility is dependent on your time preference. A high time preference person will fret about daily drawdowns. A low time preference person won’t. 15 min candles are pure noise. Even the volatility experienced over single days disappears. Weeks beat days, months beat weeks, and years trump everything else for signal. Lower your time preference; zoom out to see the price smooth out.

If you keep zooming out – decades, half centuries, centuries – even the signal of the yearly price action begins to sound like noise. Understanding just how important Bitcoin is and deciding to HODL for your children, grandchildren, even great grandchildren, you effectively neutralise volatility. Bitcoin, then, becomes an adjunct to time, over time. This is why some call it the time-chain, rather than blockchain.

You no longer feel the need to associate Bitcoin within a specific time frame. In fact, Bitcoin can help you to place more value on your future in the present, and, in doing so, any apparent volatility becomes a thing of the past.

Price

A common critique of Bitcoin is that ‘it’s too volatile to be used as a currency.’

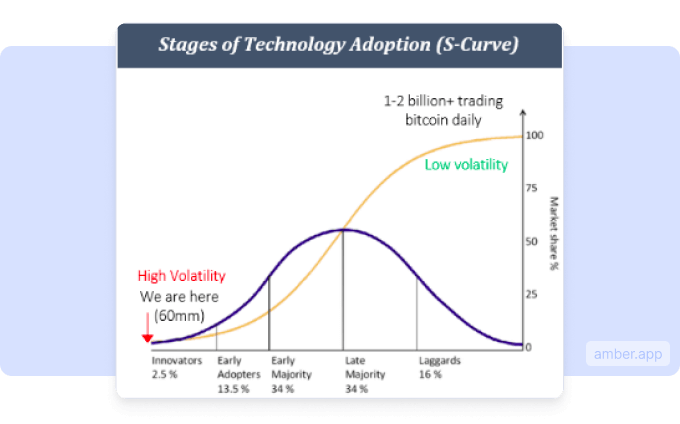

Many people have already debunked this FUD by using Bitcoin as a medium of exchange, including the entire sovereign nation of El Salvador. If the claims of more adoption equals lower volatility are true then one day these critiques will fall completely silent.

However, this relies heavily on the survival of fiat currency.

Fiat currency is one of the reasons that Bitcoin is considered volatile (plus time, as discussed above). Bitcoin has an attachment to the US dollar (or any other fiat currency, for that matter) in order to price the asset. Yet, as many Bitcoin plebs will tell you:

- 1 Bitcoin = 1 Bitcoin, and

- 1 Bitcoin will always be 1 of 21 million.

Once we hit hyperbitcoinization, might we expect the death of Bitcoin’s so-called volatility? It’s entirely possible.

The dopey FUDsters who argue that Bitcoin is too volatile to be used as a currency (medium of exchange) are the same silly FUDsters who argue that the dollar is not volatile at all (lol). When we reach hyperbitcoinization – when Bitcoin becomes the denominator on a Bitcoin Standard – then goods and assets will be priced in Bitcoin. Of course, Bitcoin will tend to fluctuate slightly in price, just as the dollar does now, but to continue to speak of volatility would be pointless.

However, you don’t need to wait till then to think about volatility in this way. Extend your time horizon and start thinking about what those sats could be worth in the future …

Beating Volatility

No matter how you think about volatility, there are two things that will always beat it: a low time preference, and Dollar Cost Averaging.

Someone with an extremely low time preference will not experience the emotions associated with Bitcoin price compared to a day-trader. Once they understand how much of a breakthrough this technology is, the price action of Bitcoin doesn’t cross their mind.

Dollar cost averaging works in a similar way. Putting away $10 a day of fiat to stack sats is very different from attempting to time the bottom and put in $1000 hoping to make a profit. Dollar cost averaging may be the slow and steady way to stack sats, but it once again removes the emotions. You no longer care whether the price is going up or down.

And if the price goes down? Well, that just means more sats per stack!

– –

Dollar Cost Averaging and a low time preference go hand in hand. This is why both of these concepts are crucial for us, here, at AmberApp. Our goal is to not only help educate people about Bitcoin, but allow you to feel comfortable in your Bitcoin exposure strategy.

If you’re ready to get started, download AmberApp to make your first Bitcoin purchase in under 90 seconds.

🔸🕳🐇