Understanding time preference and the role of money in our economy is crucial in examining the dynamics of consumption and savings. This article delves into the concept of time preference and its relation to money, exploring how fiat currency affects immediate consumption, savings behaviour, and the broader economic landscape.

Understanding Time Preference

In economics, the concept of time preference refers to how individuals value present consumption compared to future consumption. It plays a crucial role in financial decision-making, including saving, investing, and spending. When examining time preference in the context of money, a key distinction arises between sound money, represented by the cryptocurrency Bitcoin, and unsound money, represented by modern fiat currencies, such as USD and AUD, which are controlled by central banks.

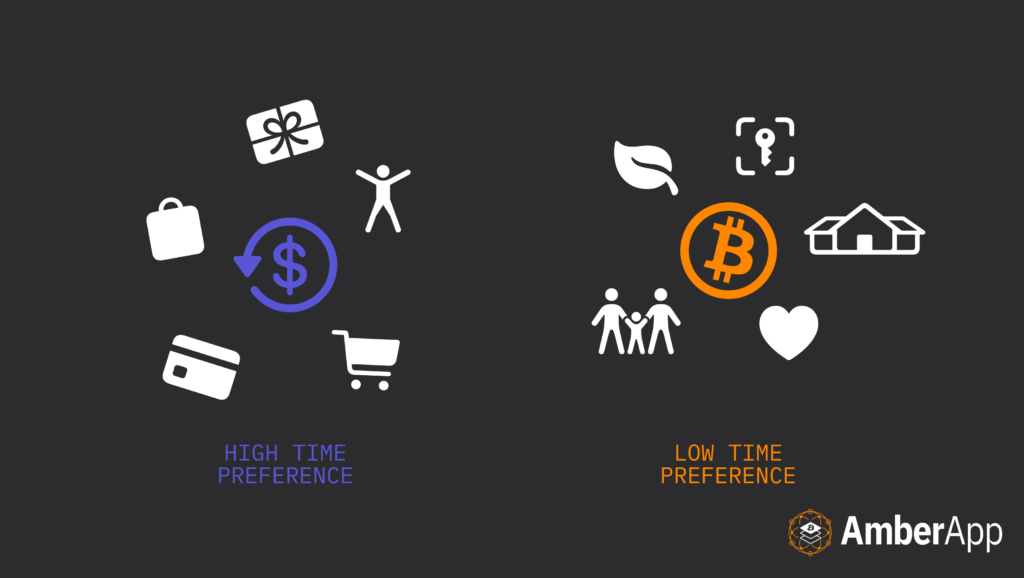

Time preference reflects an individual’s willingness to forego immediate consumption in favour of future benefits. High time preference individuals prioritise instant gratification and tend to spend more of their income on immediate consumption. On the other hand, low time preference individuals are more future-oriented, willing to delay gratification, and prioritise saving and investing.

Fiat Currency: Unsound Money

Fiat currency, such as the US dollar or euro, is considered soft or unsound money due to characteristics that affect time preference. Fiat money lacks a fixed supply, allowing central banks to manipulate its quantity through monetary policy decisions. This introduces the risk of inflation and loss of purchasing power over time.

Central banks can influence time preference by adjusting interest rates and expanding or contracting the money supply. When interest rates are artificially lowered, borrowing becomes cheaper, and individuals may be incentivise to spend and consume rather than save. This leads to the development of a higher time preference with a focus on immediate gratification at the expense of long-term goal setting and financial planning.

Furthermore, the ability of central banks to print unlimited amounts of fiat currency creates inflation, eroding the value of savings and discouraging long-term saving and investment behaviour. Inflation diminishes the purchasing power of individuals’ savings, making it more challenging to plan for the future and build wealth.

Sound Money: Bitcoin

In contrast, Bitcoin is a decentralised cryptocurrency that offers an alternative to traditional fiat currency. Its unique characteristics make it a valuable tool for mitigating the negative effects of time preference in economic decision-making. Bitcoin’s limited supply, which is enforced through code and cryptographic algorithms, creates scarcity akin to precious metals like gold.

Bitcoin’s scarcity and fixed supply curve influence time preference by encouraging individuals to save and invest rather than engage in excessive spending. Its deflationary nature fosters long-term thinking, as the value of one’s savings increases over time due to limited supply and growing demand. This encourages individuals to prioritise savings and investments for the future, promoting financial stability and more thoughtful or responsible economic behaviour.

Have you setup your SMSF yet?

Comparing Time Preference Effects

When comparing the the time preference effects of sound versus unsound money (Bitcoin vs. fiat), notable differences emerge. Bitcoin’s fixed supply and deflationary nature incentives saving and investing, fostering a lower time preference and promoting financial responsibility. In contrast, the unlimited supply and inflationary nature of fiat currency tend to promote higher time preference, encouraging immediate consumption and impeding long-term planning.

For example, consider a scenario where an individual possesses $1,000 worth of Bitcoin and another individual holds $1,000 in fiat currency. Over time, due to the limited supply of Bitcoin and increasing demand, its value may appreciate. This incentives the Bitcoin holder to save and potentially benefit from capital appreciation, aligning with a low time preference mindset. In contrast, the fiat currency holder faces the risk of inflation, which erodes the value of their savings and promotes a higher time preference by devaluing future consumption.

Conclusion

Time preference plays a vital role in economic decision-making and financial well-being. Bitcoin, with its limited supply and deflationary characteristics, encourages a lower time preference, prioritizing saving and long-term investments. In contrast, unsound money, represented by fiat currency, can foster higher time preference behaviors, promoting immediate consumption and undermining long-term financial planning.

By understanding the power and impact of time preference and the differences between sound and unsound money, individuals can make more informed financial decisions. Bitcoin’s scarcity and fixed supply provide a potential solution to the negative consequences of high time preference behavior associated with fiat currency. Embracing sound money principles can empower individuals to build a more secure financial future and promote responsible economic behaviour.

Do you want to learn more about how you can use Bitcoin as a store of value and hedge against legacy financial and economic systems? AmberApp makes it easy for you to start sacking sats in minutes.

Download AmberApp and make your first Bitcoin purchase in under 90 seconds.