₿itcoin is volatile, so they say.

But, is it?

Despite being an online crypto casino full of sh*tcoins, Coinbase gives a pretty solid definition:

Volatility is a measure of how much the price of an asset has moved up or down over time. Generally, the more volatile an asset is, the riskier it is considered to be as an investment — and the more potential it has to offer either higher returns (or higher losses) over shorter periods of time than comparatively less volatile assets.

There are three main points to take away from this definition

- Risk

- Time

- Price

With this in mind, let’s dive in and answer: is Bitcoin really too volatile?

Risk

People tend to associate volatility with risk. Generally speaking, the higher the volatility, the riskier the investment.

Yet it has been acknowledged time and time again that the risk of loss associated with not buying Bitcoin is higher than simply saving in Bitcoin. This risk increases as the inflation rate of fiat currencies accelerates around the world.

Missing out on Bitcoin means missing out on the best performing asset of the last decade (by a 10x margin). Bitcoin’s volatility is only a short term symptom of what the market is currently willing to buy and sell the asset for.

If you understand the fundamentals of Bitcoin and the problems that it solves, then any volatility correlated to risk becomes largely irrelevant.

Time

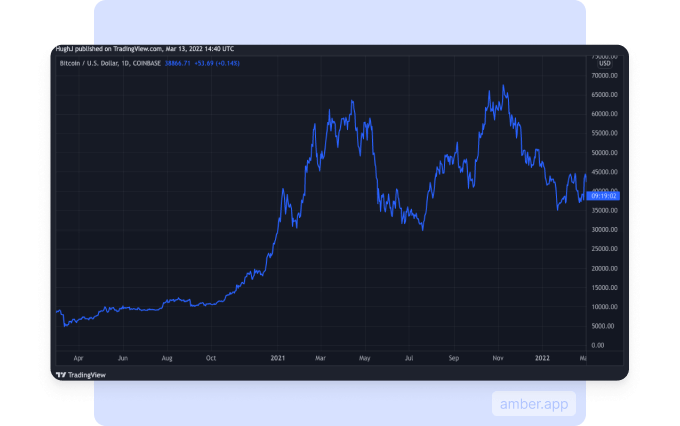

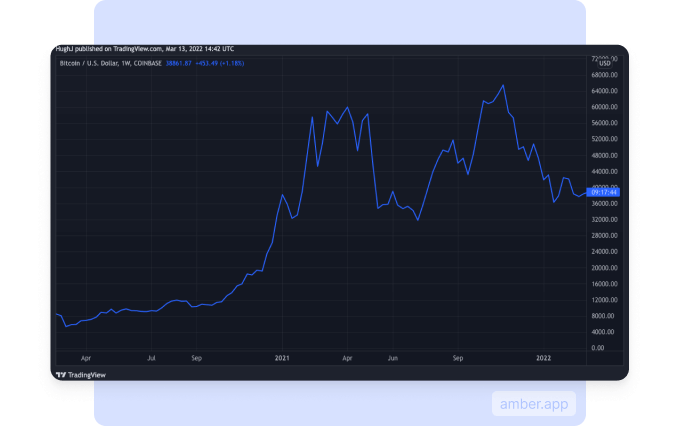

Bitcoiners love to talk about time preference. Time preference is simply how much value you place on the future over the present. Volatility is a measure of price over time. Thus, time has everything to do with volatility. As you change the timeline on something, you change the volatility.

Compared to…

Volatility is dependent on your time preference. A high time preference person will fret about daily drawdowns. A low time preference person won’t. As you zoom out and lower your time preference, you’ll see the price smooth out.

Price

Critics of Bitcoin say ‘it’s too volatile to be used as a currency.’ However, this critique relies on the survival of fiat currency.

Fiat currency is another reason Bitcoin is considered volatile because Bitcoin is priced in US dollars or another fiat currency. Yet, as many Bitcoin plebs will tell you:

- 1 Bitcoin = 1 Bitcoin

When we reach hyperbitcoinization – when goods and assets will be priced in Bitcoin – speaking about the fiat price volatility will be irrelevant.

Extend your time horizon and start thinking about what those sweet sats could buy you in a hyperbitcoinized future.

Beating Volatility

No matter how you think about volatility there is one stand-out strategy for defeating it: Dollar Cost Averaging.

Dollar cost averaging works by simply making a regular recurring purchase, regardless of the price. Putting away $10 a day in Bitcoin, for example, is the slow and steady way to stack sats, removing emotions from the equation.

Adopting a DCA strategy means you no longer care whether the price is going up or down, in fact, if the price goes down that just means more Bitcoin for your dollar!