You may have heard the phrase:

“All models are wrong, but some are useful”

This applies to many things, but in our case – Bitcoin. There are several different models that people use to assess Bitcoin. If we include people’s personal Bitcoin theses, then there are hundreds of thousands of different models out there. When “trading” Bitcoin, there are three main models that analysts use:

- Fundamental Analysis

- Technical Analysis

- On-Chain Analysis

These different type of analyses, make up of the bulk of the buying behaviours behind Bitcoin traders. Their “thought-patterns” are devised (in most part) from one of these, from here they build their own personal models. Whether it be:

- Drawing logarithmic Lines

- Watching the movement of whales’ wallets

- Judging whether Bitcoin is oversold

There are some well and truly successful traders, but there are lots of people who definitely regretted not simply HODLing Bitcoin. Trading is a hard gig, the shorter the hold-time the harder it gets.

It’s important to note, that there is nothing wrong with trading. Trading Bitcoin, penny stocks or Pokémon cards – you’re predicting the future worth (price) of something and hoping to make a profit from these predictions. However, as you may well be aware – AmberApp is not a Bitcoin trading app. We believe that accumulating Bitcoin – whether by simply dollar cost averaging or purchasing whenever you can – is the best way to approach Bitcoin and mitigate volatility.

Let’s take a dive into these three strategies that traders use to predict and profit the price of Bitcoin:

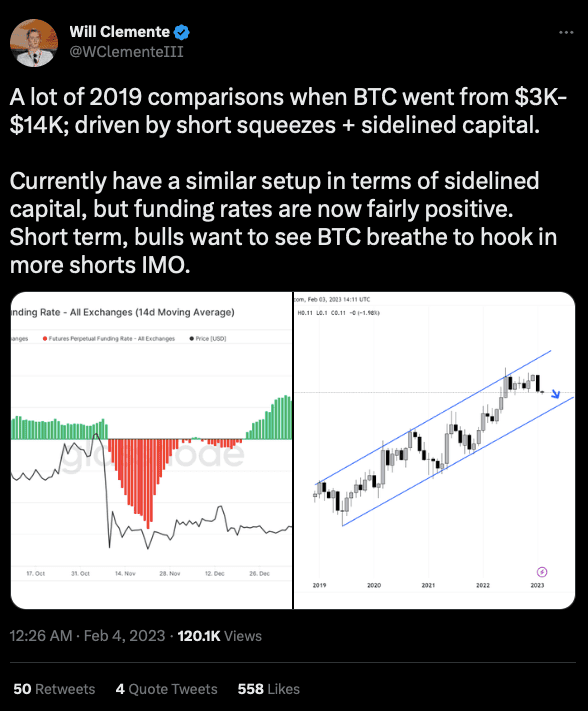

Technical Analysis.

Technical Analysis (TA), makes up the bulk of Bitcoin traders. And it follows closely to what people think traders do. Random lines all over a chart, helping someone make a prediction on whether to buy or sell Bitcoin.

TA is simply recognising patterns in previous market behaviours to make informed decisions about the future. Maybe a lot of wishful thinking, or maybe not.. but it is interesting how half of the people on Twitter, seem to be bullish about the current price and the other half seem to be bearish.

However you see it, it’s important take a step back. Away from the charts. Why do you buy Bitcoin? What does it solve? Answer those questions and TA becomes a broken tool of the past.

Think of technical analysis as:

Trying to predict whether it will rain outside based on where your pets are sitting and where they have sat in the past.

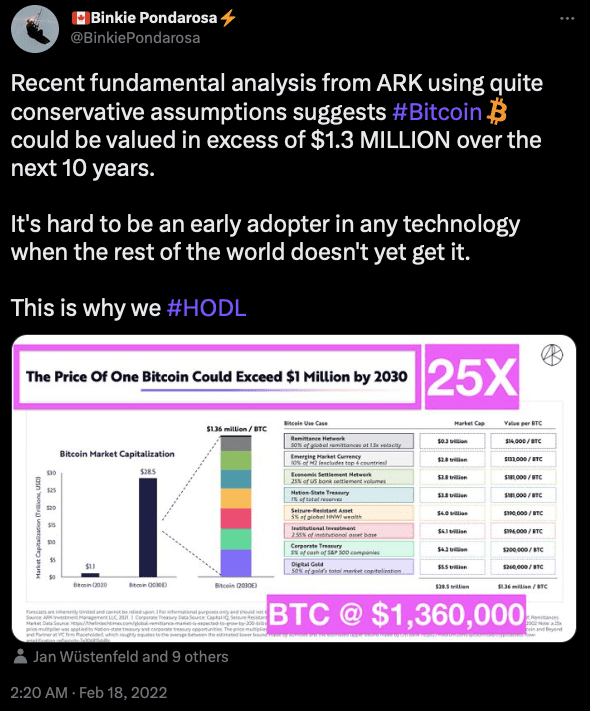

Fundamental Analysis.

The lesser known brother of technical analysis, Fundamental Analysis (FA), traditionally, is used for longer-term investors and takes everything into consideration. All the fundamentals of Bitcoin.

Analysts and traders are looking at the bigger picture to make a conclusion about Bitcoin’s current price and where it is headed. Through FA, you can’t just look at the events that are related to Bitcoin, you must look at all the macro or micro events that could impact your price prediction of Bitcoin. In a sense, making a judgement of whether Bitcoin is oversold or overbought.

Fundamental analysts are always trying to answer the question:

What is the fundamental value of Bitcoin?

When you break it down, it’s a hard question to answer. But you can extrapolate the question to anything eg. what is the fundamental value of a US dollar?

FA traders will attempt to answer this question, however, they will adapt to changes in the real-world news. For example, when China banned all Bitcoin miners in 2021. Analysts would have attempted to profit off the changes in price in reaction to this news.

Think of fundamental analysis as:

Trying to put together a puzzle, where the end product is the fundamental value of Bitcoin but, other people own some of the pieces and some of the pieces are always changing.

On-Chain Analysis.

On-chain analysis is arguably the most interesting way to trade Bitcoin. Analysts will look at the on-chain data of Bitcoin, and draw an opinion on what this means for market behaviour. Bitcoin is merely a digital public ledger, so all this data that analysts use is recorded on the BTC blockchain.

High number of miners selling? Bearish.

Block fees really high? Bullish.

Knowing whether the price will go up or down, is all based on previous market trends and patterns, in relation to the data that the analysts are looking at. Nevertheless, it does get difficult to get a realistic judgement of the market sentiment since, many people store their Bitcoin on an exchange. They may buy or sell more Bitcoin, but this never comes up on the on-chain data because it is all part of the exchange’s wallet.

Although, the data that is public, anyone can look up. There are some companies that specialise in providing this data. A very notable one is Glassnode, which has been an industry leader for a long-time. It’s always interesting to gain a general understanding of these different data points, since, they can always help you encourage friends or family to buy Bitcoin!

Think of on-chain analysis as:

Trying to judge how good a party will be based on the number of people going, the amount of alcohol in their fridges, where the party is and how much it will cost for everyone to get there.

Overview.

No matter what model you use to buy or judge Bitcoin, the most important reason to have ironed out is your “why”. Once, you understand why you buy Bitcoin, it will save you a lot of time, stress and complexity.

This may lead you to a simple approach of Dollar Cost Averaging (DCA) and HODLing (holding) Bitcoin. Which can help you escape the hassle of actively monitoring the market and making complex trading decisions. You don’t have to spend the time studying charts to determine the optimal time to buy, and you can avoid the stress of having to make rapid buy/sell decisions when you’re busy. Furthermore, you can ignore the complexity of learning market behaviors and trying to anticipate the moves of other traders.

You may think that HODLing is easy. It isn’t. When the price is down, emotions start to creep into your judgement of Bitcoin. But if you can separate these emotions from knowing why you save in Bitcoin, you won’t look back. There’s 21 million Bitcoin, don’t let go of any of them.

.png?width=1200&upscale=true&name=image%20(1).png)