October was a busy month for Bitcoin; upwards price action paired with welcomed news led to excitement. One of the month’s highlights was the approval of a Bitcoin Exchange Traded Fund within the United States. The news garnered a lot of attention, begging the question: Can Bitcoin be traded as a mainstream financial product while maintaining its fundamental purpose and identity?

Let’s break down what it truly means for the Bitcoin space – the good and the bad.

What is an Exchange Traded Fund (ETF)?

Those new to the financial world might be wondering what an ETF even is. An Exchange Traded Fund is a security (or several) that acts “like a stock market.” People can buy the ETF just like a traditional stock, allowing ease in shorting, longing and leverage trading.

Understanding ETFs comes down to breaking down the name:

- Exchange: available to access on an exchange.

- Traded: allowed to long, short or leverage as price moves.

- Fund: a collection of stocks, bonds or other assets in a single fund.

There is a wide range of Exchange Traded Funds, such as commodity ETFs, bond ETFs or even inverse ETFs. Most recently, Bitcoin ETFs have been colouring the news.

Learn more about ETFs

Bitcoin’s relationship with ETFs

Bitcoin Exchange Traded Funds are extremely new. The first is the Purpose Bitcoin ETF which traded on the Toronto Stock Exchange (TSX) from mid-March 2021. Purpose Investments claimed, “the World’s first true Bitcoin ETF is democratizing how retail and institutional investors access this powerful digital asset.” All of which is true. It allowed exposure to a field of people who traditionally would stay away from Bitcoin.

Over six months later, the United States announced a Bitcoin ETF would begin trading in October. The ProShares Bitcoin Strategy ETF started trading on 19 October 2021 and collected more than $1.1BUSD worth of assets in just two days. This displays how hungry the New York Stock Exchange (NYSE) was for a Bitcoin traded ETF.

Consequently, an additional ETF began trading in the US – Valkyrie Bitcoin ETF. Both US ETFs, however, share something distinctly different to the Canadian Purpose BTC ETF. The US ETFs are both futures-based compared to being spot Bitcoin like the Purpose ETF.

Spot Bitcoin

How it occurs on AmberApp! You buy Bitcoin, and you own it. In relation to an ETF, the fund will buy physical Bitcoin when you buy into the fund.

Futures Bitcoin

Speculation trading. Two parties agree on a predetermined price at a given date. When the contract expires, the price is paid at either a premium or a discount. The ETF will complete the contracts for you.

With the recent success of the US-based Bitcoin ETFs, more countries are seemingly interested. In Australia, you can expect a Bitcoin ETF in the near future. The Australian Securities and Investments Commission (ASIC) is interested in approving a spot Bitcoin ETF due to the “the interest in, and demand for, ETFs and other investment products that hold crypto-assets in Australia.”

It’s only a matter of time before Bitcoin is exposed to most of the global financial sector.

Bitcoin community’s thoughts on BTC ETFs

There is a discrepancy within the Bitcoin community about the pros and cons of a Bitcoin ETF, which can be broken down into the value of Bitcoin Exposure vs Bitcoin Understanding.

Let’s dive into the positives associated with the approval of a Bitcoin ETF in the US.

What Bitcoin ETFs bring

Securities and Exchange Commission trust

Bitcoin is still seen as a very speculative asset by many; it’s young, original and hard to understand. The approval of a Bitcoin ETF indicates the US Securities and Exchange Commission (SEC) are slowly understanding the asset – or attempting to. The SEC is a very influential agency whose approval of Bitcoin is being reflected by other monetary agencies around the world. For example, the ASIC now wants a Bitcoin ETF only after approval in the United States. This increasing trust in Bitcoin is essential for the asset to grow.

The Winklevoss twins pushed for a Bitcoin ETF in 2013 and were turned down by the SEC. They tried again in 2017 and experienced the same result due to Bitcoin failing to follow “rules of a national securities exchange designed to prevent fraudulent and manipulative acts and practices and to protect investors and the public interest.”

The statement by the SEC in 2017 clearly showed they knew very little about Bitcoin at the time, and it was still carrying stigma related to its infamous history on, The Silk Road. The announcement in 2021 shows they are more mature in making decisions around Bitcoin and that something has changed with their understanding of Bitcoin.

However, we must be wary not to buddy up with the SEC after their approval of a BTC ETF. The choice to approve an ETF was influenced by the public, who had constantly been calling for one, so we must take a moment to assess their motives critically. A popular saying in the Bitcoin community is, “don’t trust, verify,” and we must take the same approach with the SEC and other monetary organisations.

Increased exposure

Bitcoin ETFs will undoubtedly bring more exposure to Bitcoin. Money that was limited to the traditional financial sector is now available to contribute to the Bitcoin market cap. This is undoubtedly the biggest reason people are celebrating the approval of the ETFs.

Michael Saylor, an extremely prominent Bitcoiner, has expressed his views on this exposure, “when the sector (baking sector) evolves when we have the Bitcoin ETF in the US. Billions and billions of dollars will flow into Bitcoin.” These views are supported by the ProShares Bitcoin Strategy ETF being the fastest ETF to reach $1B worth of assets.

It’s a snowball effect when one ETF gets approved – it’s more likely that another will be approved as well – exponentially increasing the exposure rate across the globe. Considering ETFs are limited to the countries they are approved in, other countries would need to allow an ETF to expose their populations to Bitcoin.

Unlike other assets traded as an ETF, Bitcoin can be purchased outside an ETF! Surely the approval of Bitcoin ETFs in the US made people in the UK buy because it’s good news for the network. The approval of the ETF was closely correlated with an upwards price action and an all-time high, which would support that everyone benefits from a single ETF approval.

Lastly, the hope is that someone buying a BTC ETF is doing their research – not on Bloomberg and WSJ, but through podcasts and investigating people who hold the asset. A BTC ETF should allow people to be interested in what Bitcoin does since they now have some BTC in their portfolio. This increased exposure in people who understand what Bitcoin is will fast-track the route to hyperbitcoinisation.

Bitcoin ETF issues

The acceptance of a Bitcoin ETF is also associated with wariness from some members of the Bitcoin community. Highlighting that “buy Bitcoin” does not mean “buy Bitcoin ETFs”. This is because a Bitcoin ETF fundamentally misrepresents what Bitcoin is. By financialising the asset, the Wall Street mob have displayed Bitcoin as something that’s supposed to be traded and speculated on.

We cannot escape that Bitcoin will not be traded. Any asset, no matter what it is – even Bitcoin – will have people trying to make a quick profit. This is where a number of Bitcoiners see a conflict with the arrival of BTC ETFs; it is skewing Bitcoin in its entirety.

Bitcoin has several properties, but two major ones are contradicted by buying a Bitcoin ETF. By buying Bitcoin spot or futures ETFs, people are not experiencing the world-changing fundamentals of Bitcoin.

Bitcoin Fundamentals

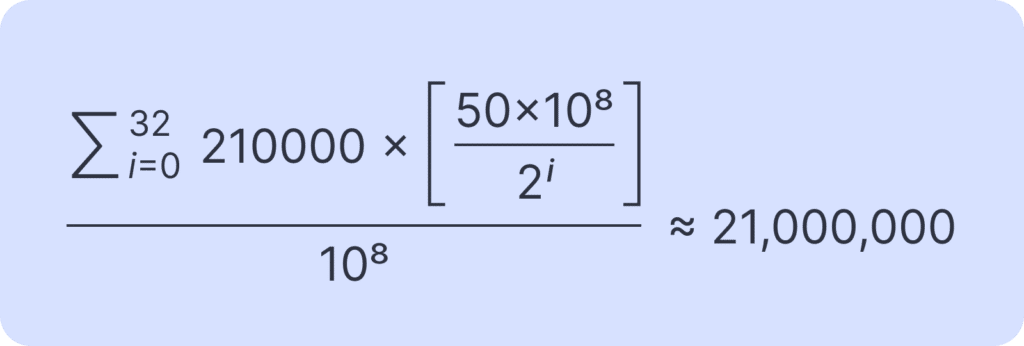

Absolute scarcity

A Bitcoin ETF is a price peg to a Bitcoin. By thinking in these terms, we are still denominating our Bitcoin in dollar values. Bitcoin being unbreakable by its maths makes it the only truly scarce asset known to humankind other than time.

By appreciating this notion of Bitcoin, the accumulation of satoshis (base unit of Bitcoin), should be the only goal. Although, when someone is buying an ETF, they are not accumulating any satoshis. They might see their portfolio balance go up in dollar terms, but it is the fund that owns the physical bitcoin (if it is a spot ETF). If the dollar was to aggressively inflate and collapse, the ETF would probably fall with it.

An investment into a Bitcoin ETF is not a hedge against hyperinflation. Your satoshis, your new money is. Your Bitcoin is not inflating at an unknown, manipulated rate. Its steady rate of production ensures that people are aware of the limited supply being mined. When we hit 90% total mined in December 2021, people will open their eyes to how truly scarce their satoshis are.

Absolute self-sovereignty

Not your keys, not your coins. Bitcoin changes the monetary game, by allowing the owner to have complete control over their Bitcoin. At AmberApp, we encourage you to get your Bitcoin off the platform into a hardware wallet when you feel comfortable in doing so.

Albeit AmberApp does hold your Bitcoin in cold stored collaborative custody wallets. If you’re interested in taking the next step on your Bitcoin journey, check out this guide!

In contrast with AmberApp, you don’t control anything on the ETF. Yes, you can choose whether you short, long or leverage your money but that’s all. There are even market hours for a Bitcoin ETF – you can’t trade 24/7!

Bitcoin is a peer-to-peer, decentralised system that removes the third party. By buying Bitcoin through an ETF, you are still going through a third party, which largely defeats the original raison d’etre. Bitcoiners encourage you to control your coins, so no one has the power to take them from you.

By stepping into the direction of the financial Wall Street game through ETFs, we are once again being reliant on someone else. Self-sovereignty through private keys changes how the financial sector will function as the need for “useless” companies collapses. Be your own bank – buy Bitcoin.

Final Thoughts

The number of Bitcoin ETFs will only continue to grow globally; there is no escaping that. We should take this as a positive for the Bitcoin network; the more exposure people have to Bitcoin, the better.

However, if you’re reading this, you probably already own the asset or are very interested in it. You will be rewarded by the approval of Bitcoin ETFs in terms of price action, whether that is important to you or not. A Bitcoin ETF is like eating fake meat; it’s not the real product.

Whilst you may get some benefits: simplicity to trade and inclusiveness on a current exchange, you lack the real benefits of the actual product – Bitcoin. We must be wary that Bitcoin ETFs don’t embody what Bitcoin represents – it’s only the financialization of the asset.

If you want the true Bitcoin experience – stick to accumulation and stacking sats on a product like AmberApp over an ETF. There’s only 21 million out there, and you want as many of them as you can get.