Irony of the Kybernan

Contrary to a well known Internet myth, the word “government” is, in fact, a nautical term, borrowing from the Ancient Greek word, “kybernan”, which means to steer or pilot a ship. In a twist of irony the same word “kybernan” is also the root of the word “cybernetics”.

I’m calling it irony because government rule by some of the people is in the early stages of being superseded by certain cybernetic rules for all of the people. Despite a glut of words from politicians of all stripes, history is compelling in that government of the people for the people has been a rare exception, rather than the rule.

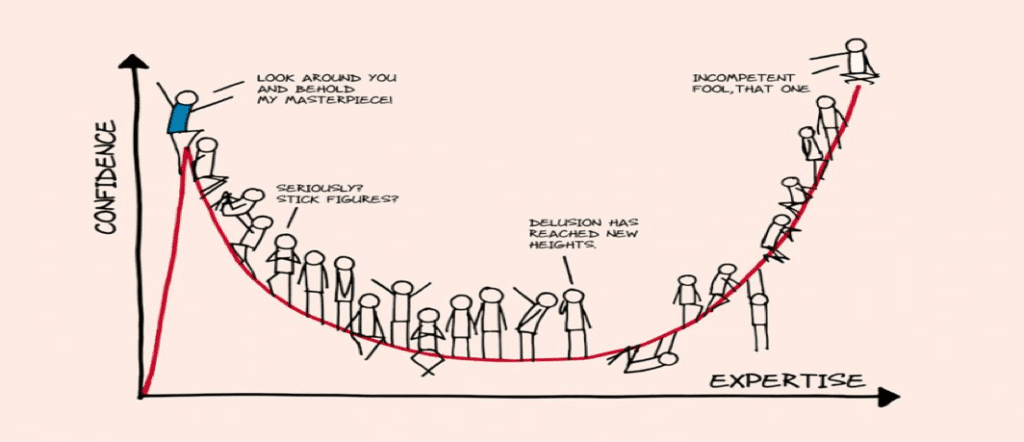

The Dunning-Kruger effect occurs when people believe that their knowledge or ability in a specific area is much greater than it actually is. It tends to occur due to a lack of self-awareness preventing an individual from accurately assessing their own knowledge and abilities; their skill set. The opposite to Dunning-Kruger is the impostor syndrome, and it applies when people underestimate their knowledge and abilities.

The image below demonstrates both concepts.

If you’ve ever personally traversed the graph above in even a single field, you’ll know how easy it is to fall prey to both poles of this same effect. After comprehending how little you know, and can ever know, it’s just good policy to doubt yourself.

If you want proof of that statement, stand in any university library sometime, pick a book off the shelf at random and start reading. That experience can be humbling.

“₿itcoin is freedom,” as they say. It’s also cybernetic governance that is going to impact human societies in ways present-day human governments don’t yet appreciate. After some five thousand years of formal human government I’d argue that the record indicates, clearly, that most state entities have a low ability to exercise good governance (relative to Bitcoin), while consistently overestimating their own abilities to govern well. Brief periods of success are inevitably followed by disaster, often disguised as “emergency”.

In this instance, Dunning-Kruger puts most world governments (and unelected NGOs, like the BIS and IMF) at the top of that first peak, because they tend to think that they have figured out the solution to the nuisance that is Bitcoin.

The vast majority of human governments automatically default to exercising their control using the principle that “might makes right – aka “the law of the jungle”. Having had this approach work (more often than not) throughout most of history, I think they can be shown some forgiveness for wanting to cling on to such an axiom. However, it calls to mind another saying; “it always works right up until it doesn’t,” which, perhaps, is not an adage most Western governments have ever had to face before.

The Protocol Rules

Similarly, and simultaneously, such governments tend to instinctively underestimate the regulatory abilities of the Bitcoin protocol to enforce good governance in and of and all by itself.

Better governance, compassion, and humanity being delivered by a protocol – as opposed to humans – doesn’t even register with our most senior value-extracting bureaucrats. Until this last decade, these meatspace authorities and their all too human predecessors have only ever known of such things to be controlled by people. To them, a protocol operating without a human veto is an alien concept. The concept becomes even more alien when the only permissible changes require a huge human majority (consensus) that tends to increase the overall power of the protocol in control.

The traditional way that governments have demonstrated their success is via a growth in size, or a growth in their overall power to influence certain societal norms at the whim of the rulers. Such whims are not laws because there exists a few rulers who can – and do – change the agreed upon set of rules in an instant, or even retrospectively. With the dawning of government by network consensus – rules rather than rulers – I still see success being judged solely on the growth and security of the network itself.

With Bitcoin, success is measured by the degree of adherence to the set of immutable rules, as opposed to the discernment and approval of only a few rulers – whether elected, or otherwise. In short, this is an extremely distasteful scenario for the political few, whereby the same rules apply both for me and for thee.

Twenty-one-million, or less – but, no more – is going to be despised to the level of derangement by the vast majority of our current incumbent human rulers. Indeed, many are flailing around in denial about it, right now.

Given that the Dunning-Kruger effect applies indiscriminately to all humanity, it is not surprising that most regulators are positioned at the inflection point on the upper left-hand-side of thatg diagram. Even if some open-minded members of today’s governments have put considerable effort into trying to understand Bitcoin, the overwhelming majority of senior bureaucrats are yet to wake up to what’s currently unfolding. The understanding that a distributed network can’t be corrupted, coerced, and is extremely difficult to co-opt, will take a long time to sink into their blinkered consciousness.

For obvious reasons, most regulators focus on proven techniques, of what has always worked in the past. Concentrating on the behaviour of the people subject to their rule has always worked before, so why not now?

This time is different. This time, it’s the protocol that governments will want to try to control (as well as the humans). The really awkward part, however, is that in order to achieve that objective each and every communication channel would need to be brought under a centralised command and control structure, forever. And that’s just not going to happen. In 2022, any such controls operating at less than that level will only delay Bitcoin’s ultimate adoption over time. It will not stop it.

Rise, the Unbanked

The preferred regulatory regime is to apply a “death by a thousand cuts” approach. This will be no different with Bitcoin. KYC is the fine edge of the blade. Regulators believe a ‘top down’ approach that enforces KYC provisions to every transaction is the answer. If such a regime can be imposed on every nation state that interacts with the global financial infrastructure, then that may enable sufficient surveillance. Then, Bitcoin stands a chance to be captured and co-opted.

Regardless, it is going to be very interesting when the “old-school” rulers have that first, deep understanding of traditional political bases shifting to a differentiation based on Bitcoin. I suspect it’s not going to be the major world governments or their rich, privileged, and mostly unaware citizens who determine the success or failure of Bitcoin. No, it will be the global unbanked and the global unbankable who first turn to Bitcoin – in desperation.

This is because they possess the insatiable incentive to fight with fanatical devotion to maintain Bitcoin’s original design parameters, especially once they understand and comprehend it.

These are the super majority who already know just how disastrous and diabolical recreating the fiat standard in cyberspace would be. Cybernetic government for the benefit of the people is becoming more and more inevitable with every 10 minutes that passes us by. Let us hope that good governance prevails by piloting a course of safe hourbous within cyberspace.

Tick tock, next block. ⏱

– –

Keen to increase your ₿itcoin knowledge? Join the tribe and subscribe to Amber Analysed – our monthly newsletter featuring the best of the best from the blog, acute market insights, podcast recommendations and more. 🔸

If you’re ready to help build a world based upon fair and equitable rules download the AmberApp and start saying no to rulers and their arbitrary ways, and yes to the Bitcoin protocol – in under 90 seconds!

🔸🕳🐇