Do you know how much money you need to save for a comfortable retirement or financial independence? Let’s dive into the numbers and forces that play against you working towards your retirement and financial freedom. While you might be savvy enough that you’re already saving for a rainy day, financial independence or retiring when you’re old and grey, the purchasing power of your money will fall by 50% in about eight years with inflation at its current rate of 8.5% (in the USA). Sure, it’s a fall from the last reading of 9.1%, but it still means the price of everything is going up, just marginally slower. Now is the time to understand how to maximise the value of your hard-earned dollars, even in a world with institutions and people hell-bent on making a secure and free financial future impossible.

Who doesn’t want to work longer and harder?

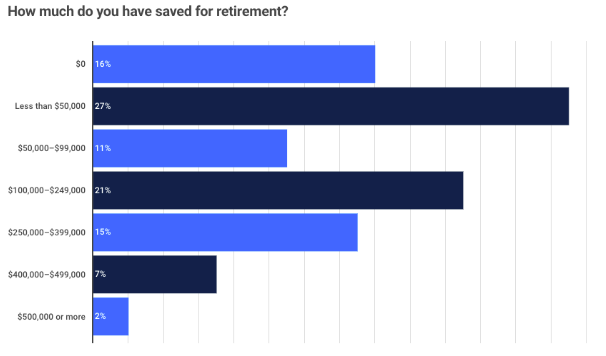

A recent study found that Americans have only saved half the money they need for retirement, with the median amount saved just $71,500.

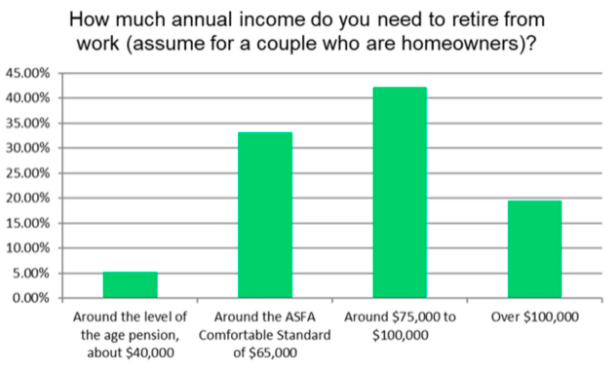

With inflation nearing 10%, your income has to stretch further while a comfortable financial future gets more out of reach every day. You are a cog in the very system that’s keeping you trapped, financially strained, and exhausted. As Vicki Robins puts it in, Your Money or Your Life, you’re “making a dying”, not making a living. “The key is remembering that anything you buy and don’t use, anything you throw away, anything you consume and don’t enjoy is money down the drain, wasting your life energy and wasting the finite resources of the planet. Any waste of your life energy means more hours lost to the rat race, making a dying. Frugality is the user-friendly and earth-friendly lifestyle.”— Vicki Robins, Your Money or Your Life. Know your numbers to start living and stop ‘making a dying’ And back across the Pacific in Australia, a recent survey has found that most couples need an income of AUD75,000 to AUD100,000 per year to retire comfortably. Saving this amount in the first place is hard enough let alone inflation eating away at it!

Let’s say you save $1 million for retirement and spend $50,000 each year. Your money will run out in 20 years with inflation at 3% and an annual return of 3%. With inflation at 12%, your money would run out in 11 years and nine months. In the US, the average retirement age is 63, leaving you with a lot more life at the end of your money. Not only does inflation erode your purchasing power, it literally robs you of your time by driving the need for you to work longer and take on growing debt for everything: buying a home, educating your children, enjoying life, and eventually retiring. With the above in mind, the human hamster wheel that is the fiat system becomes clear. At first, it can feel heavy, but it also opens up an opportunity to think about how you can structure your life to opt out of the hamster wheel as soon as possible. Inflation is robbing you of your time and freedom Whether you’re a painter, an accountant, or a content creator, you, in some capacity, need to trade your time for money. Of course, you may not be directly charging by the hour, but your time and energy goes into creating products and services that people pay you or your employer for in return. Therefore, the money you receive for your time and effort is a product of your energy (unless you’re disgustingly close to the money printer of course). It’s a demonstration of the value you’ve created for the world. And then it’s up to you to make sure you’re putting that money to work. So, what do you do in an inflationary environment? Save and invest to buy your future self time and freedom (read: adopt a low time preference). In the FIRE movement, the general rule of thumb is that you reach financial independence when you have saved 25 times your annual expenses.

Do you know your numbers?

What short-sighted spending can you stop today and redirect to give yourself the gift of freedom from the rat race? Getting conscious about your spending is smart at the best of times, but especially when inflation threatens your ability to retire in your early 60s.

You need a store of value for your time and energy

As a relatively young asset, Bitcoin’s price is still quite volatile. However, with its limited supply and decentralised nature, its value can’t be debased by a central authority. It is a path out of the rat race and the ultimate middle finger to a corrupt and broken financial system. While saving some cash for a rainy day is wise, you also need a long-term store of value for your time and energy spent creating value for the world. Without it, your toiling never stops, and the rewards for your efforts can be debased in a single meeting of men in suits around a table (read: central banks raising rates to curb the inflation they created). In the fiat world, your financial future is in dirty hands. With Bitcoin, your financial future rightly returns to your hands. “Bitcoin is the cheapest way to buy the future, because Bitcoin is the only medium guaranteed to not be debased, no matter how much its value rises.”— Saifedean Ammous, The Bitcoin Standard: The Decentralized Alternative to Central Banking