“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” – Henry Ford.

“The process by which banks create money is so simple that the mind is repelled.” – J.A. Keynes.

For centuries, fiat currency has stood as the cornerstone of global economies. Under this monetary system, governments and central banks issue currency without the backing of any physical asset. Despite its extensive adoption, fiat currency harbours inherent shortcomings, with susceptibility to inflation standing out as a pivotal concern.

The Monetary Underpinning of Inflation

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” (Friedman, 1970). This succinct statement encapsulates the essence of inflation – a rise in the money supply leading to a general upswing in prices of goods and services within an economy. This perspective on inflation aligns with the Austrian School of Economics, a paradigm that accentuates the role of individual human action and market dynamics.

From the vantage point of the Mises Institute, inflation is predominantly viewed as a monetary occurrence precipitated by an expansion of the money supply, diverging from mainstream economic viewpoints that attribute it to increases in production costs or other extraneous factors. Consequently, inflation entails a progressive escalation in the overall price level of goods and services within an economy. With more money in circulation vying for the same pool of goods and services, heightened demand invariably propels prices upward.

Governmental Machinations and Fiat Currency

Fiat currency, however, is not merely subject to the forces of economic dynamics. Governments wield the power to manipulate it, and this prerogative poses profound challenges. The control governments exert over the money supply can be leveraged for the benefit of specific interest groups or industries, often sowing seeds of distrust in both the currency and the governing bodies.

Henry Ford’s insightful observation, “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning,” underscores the potential consequences of public obliviousness regarding the intricacies of the monetary system. Increased awareness of the system’s operations and susceptibility to manipulation could conceivably foster widespread discontent, inciting calls for substantial reforms within the financial structure.

In dire circumstances, governments have resorted to exploiting their money supply control to fund wars or military endeavours. This, in turn, exacts a dire toll on both the nation’s economy and its overall well-being. Such extreme measures underscore the perilous ramifications of unwarranted monetary manipulation.

Central Bank Digital Currencies (CBDCs): A Double-Edged Sword

In the quest to modernise the financial landscape, Central Bank Digital Currencies (CBDCs) have emerged as a promising innovation. These digital currencies are issued and guaranteed by central banks, aimed at streamlining financial transactions. However, beneath their veneer of efficiency lies a concealed facet that warrants scrutiny.

CBDCs harbour the latent potential to serve as instruments of governmental surveillance and control over individuals. Through CBDCs, governments gain unprecedented access to a comprehensive transaction ledger, effectively dismantling the sanctity of financial privacy and individual autonomy.

The capacity to monitor and freeze individual accounts or impose spending limits with CBDCs poses a grave concern. It places disproportionate authority in the hands of governments, subjecting individuals to unwarranted financial oversight.

CBDCs empower governments with the capability to scrutinize every transaction conducted by individuals, raising profound apprehensions regarding privacy infringement and personal liberty. This extensive surveillance might be exploited to discern spending patterns and financial behavior, potentially leading to unjust targeting by law enforcement agencies, all in the absence of adequate legal safeguards.

Moreover, CBDCs open the door for governments to manipulate the ebb and flow of funds into and out of individual accounts. By dictating spending limits and freezing assets, governments could substantially curtail financial independence, ensnaring individuals in a web of governmental financial control. This shift threatens to erode personal financial autonomy, leaving individuals subject to government-orchestrated monetary decisions.

Have you setup your SMSF yet?

Bitcoin’s Unique Advantages in a Changing Financial Landscape

In contrast, Bitcoin stands as a bastion of decentralization, endowing individuals with an unparalleled degree of autonomy absent in conventional fiat currencies or Central Bank Digital Currencies (CBDCs). Echoing the sentiments of Saifedean Ammous, the esteemed author of “The Bitcoin Standard,” Bitcoin shines as the inaugural decentralized digital currency, impervious to the dominion of central authorities or intermediaries.

This impregnability poses a formidable challenge to governments seeking to control monetary currents or manipulate currency dynamics. Furthermore, the cloak of anonymity enveloping Bitcoin transactions bestows an aura of privacy and security that eludes traditional fiat currencies and CBDCs.

Bitcoin’s finite supply, capped at 21 million coins, erects an impenetrable fortress against the erosive forces of inflation that plague fiat currency. Augmenting its resilience is the decentralized architecture of Bitcoin, which nullifies attempts at manipulation by central entities, erasing any single point of vulnerability susceptible to governmental or other external influences.

In addition to these bedrock attributes, Bitcoin offers a degree of financial self-governance that remains beyond the grasp of traditional fiat currencies. Its peer-to-peer transactional framework bypasses the need for intermediaries, including banks and payment behemoths such as Visa or Mastercard. This empowerment resonates profoundly in countries or regions where the banking sector lacks credibility or where individuals are estranged from conventional financial services.

To conclude, while fiat currencies have dominated the financial realm for centuries, they bring with them considerable baggage, rendering them unsuitable for the contemporary financial milieu. The latent potential of CBDCs to serve as instruments of governmental surveillance and control looms ominously, while the intrinsic susceptibility of fiat currencies to inflation and manipulation persists.

Enter Bitcoin, a decentralised digital currency par excellence, heralding transparency, security, and immunity to inflation. In an evolving financial ecosystem, Bitcoin stands resolute as an orange beacon of change, offering a glimpse of a more equitable and decentralised monetary future.

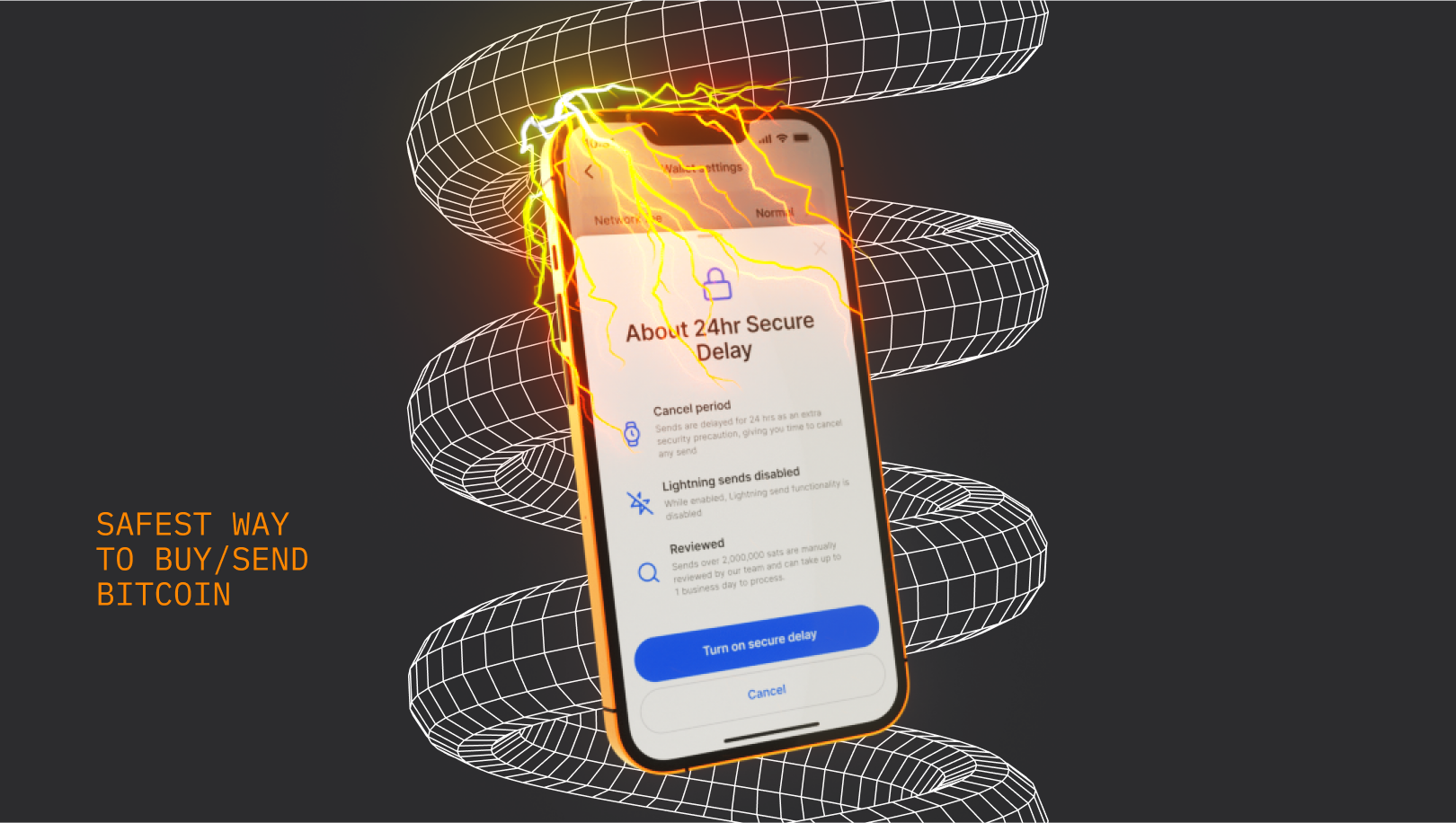

Learn More

Do you want to learn more about Bitcoin and why money matters? Click this link to keep reading. Download the AmberApp and start stacking sats in minutes.