Throughout history, gold has held a special place in the human psyche, symbolising wealth, power, and stability. Beyond its physical beauty and rarity, gold has served as a form of currency, and its role in the evolution of money is nothing short of remarkable. In this exploration, we delve into the multifaceted nature of gold as money, it’s distinctive characteristics, advantages, limitations, and the fascinating transition from commodity money to fiat currencies.

The Allure of Gold: A Distinctive Form of Money

Gold’s intrinsic value and enduring nature make it an exceptional form of money. Its utility extends far beyond its aesthetic appeal. Several unique characteristics set gold apart as a medium of exchange:

- Durability: Gold stands the test of time. Unlike many materials, it does not corrode or decay. This durability ensures that it retains its value over generations.

- Scarcity: Gold’s scarcity is a fundamental aspect of its value. There exists a finite supply of this precious metal, and this inherent limitation shields it from inflationary pressures.

- Divisibility: Gold can be divided into smaller units without compromising its overall value. This divisibility feature allows for flexibility in transactions, regardless of the scale.

- Recognisability: The distinctive colour, weight, and purity of gold make it instantly recognisable and verifiable. This characteristic fosters trust among those using gold as a medium of exchange.

The Limitations of Physical Gold as Money

While gold possesses remarkable attributes, it is not without its limitations. These drawbacks have influenced the evolution of monetary systems over time:

- Portability: The physicality of gold presents a logistical challenge. Its weight and bulkiness make it impractical for individuals to carry or store large quantities of gold securely.

- Divisibility Challenges: Dividing gold into small units can be complex, especially for minor transactions. The lack of smaller denominations hampers its everyday use.

- Verification Complexity: Authenticating small amounts or individual gold coins can be a cumbersome process, making it less suitable for everyday transactions.

The Emergence of the Gold Standard and Trusted Third Parties

To address some of these limitations and facilitate gold’s use as a medium of exchange, the gold standard emerged. Under this system, paper currency was directly tied to physical gold, assuring its value and making it more practical for everyday transactions. However, the need for trusted intermediaries, like central banks, to verify gold’s legitimacy became increasingly essential.

The Advent of Fiat Money: A Shift from Physical to Abstract

The Federal Reserve Act and the introduction of Income Tax in 1913 marked a crucial turning point. Fiat money, not backed by physical assets like gold, became the new norm. This shift from commodity-backed money to fiat money was driven by the necessity for trusted third parties to ensure the legitimacy of currency.

The Nixon Shock: A Pivotal Moment in Monetary History

In 1971, the “Nixon Shock” forever altered the landscape of global finance. To address economic crises, President Richard Nixon suspended the convertibility of the US dollar into gold, effectively ending the Bretton Woods system. This landmark decision had far-reaching consequences, including a significant devaluation of the US dollar and a surge in gold prices.

Have you setup your SMSF yet?

The Petrodollar System and the Reinforcement of Fiat Currency

To maintain the US dollar’s global dominance, a new financial system emerged. From 1971 to 1973, agreements between the United States and oil-producing nations resulted in the petrodollar system. In this arrangement, these nations priced oil exclusively in US dollars and reinvested their oil revenues in US financial assets. In return, they received US military protection and support for their political interests. This system substantially increased global demand for US dollars, cementing its status as the world’s primary reserve currency.

Conclusion: The Dynamic Journey from Gold to Fiat Money and Beyond

The history of gold as money is a testament to human ingenuity and adaptability. While gold’s unique attributes still command respect and admiration, the modern world relies on fiat money and abstract financial systems. The “Nixon Shock” marked a pivotal moment, emphasising the importance of currency in international trade and diplomacy.

However, the future of money is not static. In recent years, a new contender has emerged on the financial horizon – Bitcoin. This digital cryptocurrency, with its decentralised nature and finite supply, is challenging the traditional notions of money. Just as gold once replaced barter systems, Bitcoin is positioning itself as a replacement for gold as the future of money.

Through its rich history, gold continues to shine brightly, symbolising both enduring value and the evolving nature of wealth. Yet, as we venture further into the digital age, the financial landscape may see the gradual integration of digital money, like Bitcoin, shaping the future of money in unprecedented ways. The journey from gold to fiat money is a chapter in this ongoing saga, with the next chapters still waiting to be written.

Learn More

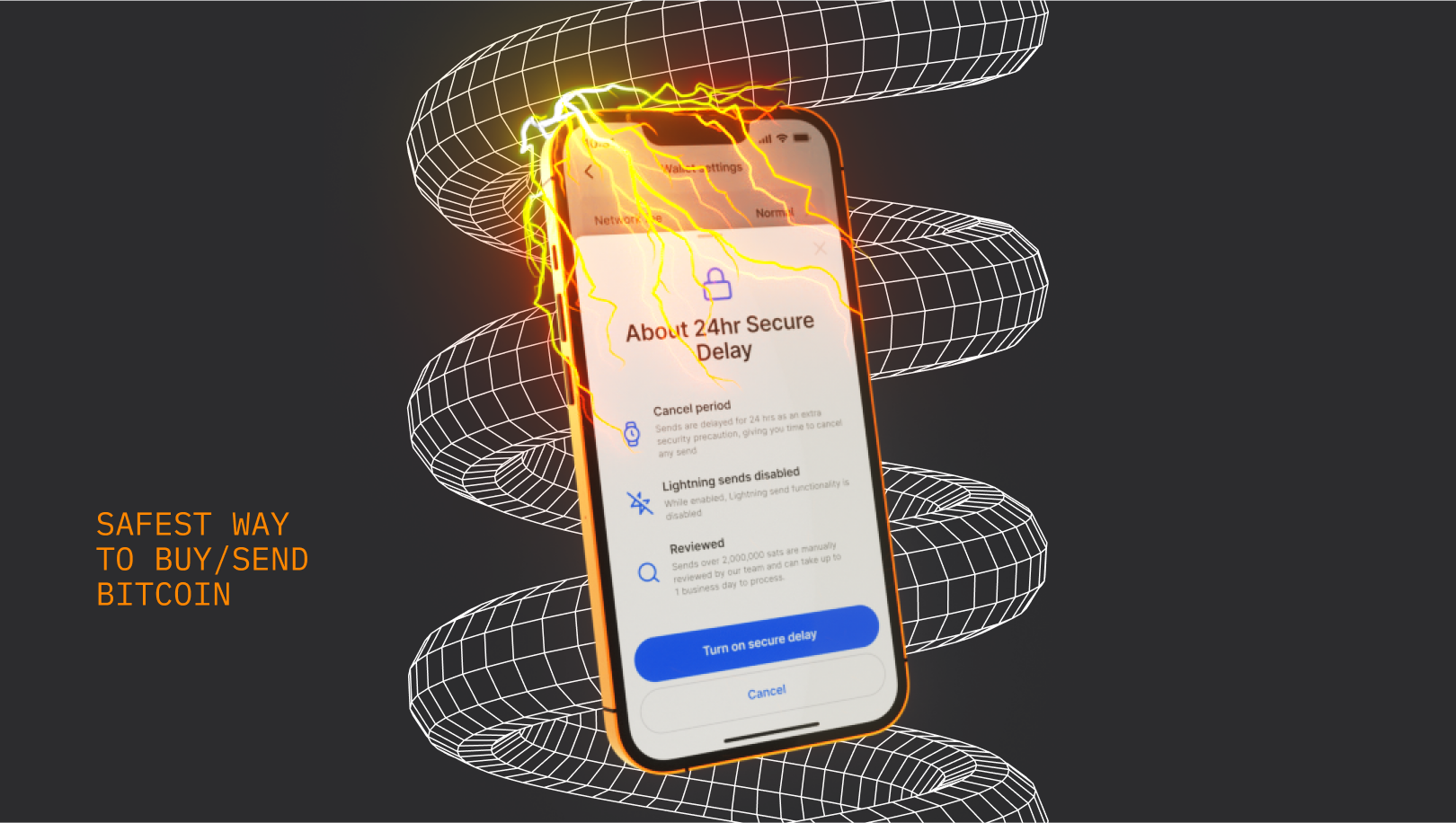

Do you want to learn more about Bitcoin and why money matters? Click this link to keep reading. Download the AmberApp and start stacking sats in minutes.