What a year it has been. 2022 was full of mixed emotions in the Bitcoin community; “black swan” events rocked the industry, more BTC-only individuals emerged and we saw developments into the future of our industry.

Despite all the drawdowns of 2022, did Bitcoin ever fault? No. BTC had an uptime of 100% throughout the year. Further validating the case for Bitcoin to become the most important asset in the global economy.

Firstly, we would like to thank everyone who stuck with AmberApp to stack Sats throughout the year. If you are buying now, then you truly understand Bitcoin and your why behind buying it. All of our users made it possible for us to take a massive step forward in 2022, and expand our services to 51 more countries. We are so grateful to be in a position to expose and teach more individuals on the fascinating topic of Bitcoin.

The Bitcoin community didn’t sleep throughout 2022 and our biggest takeaway from the year was:

Don’t trust, verify.

This phrase is a staple of the BTC community, because it provides a foundation to why Satoshi created Bitcoin in the first place. Instead of putting trust in a 3rd party, Bitcoin was designed to be a peer-to-peer electronic cash system.

Removing the unnecessary middleman.

Through the use of nodes and a digital, public ledger, everyone can verify the transactions that are made. This process of verifying, not merely trusting was highlighted in 2022.

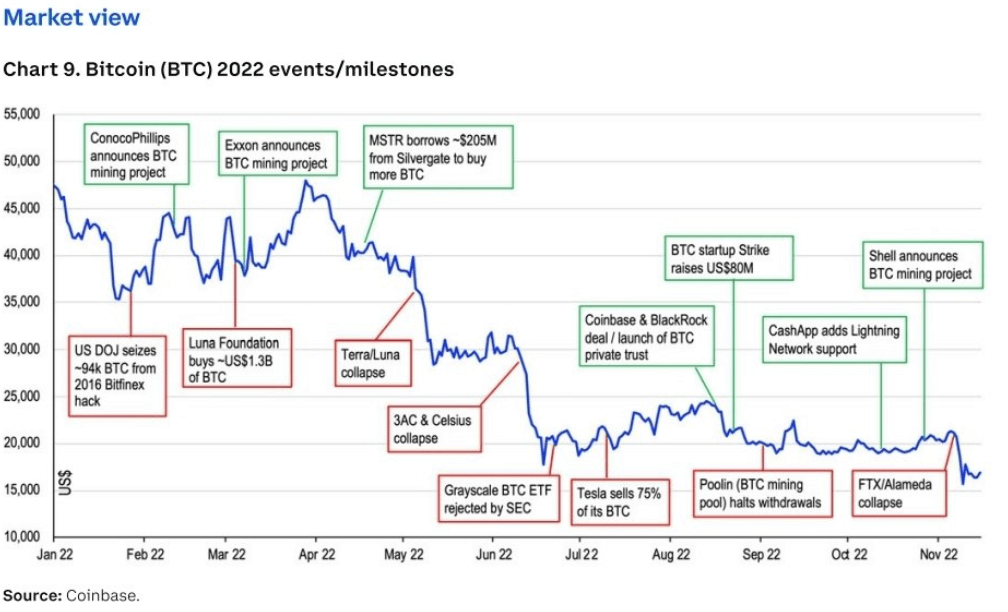

Luna, Terra, Celsius, Voyager, FTX – all collapsed. People put trust into these different entities or cryptocurrencies and were ruthlessly used to generate money for those who controlled the centralised organisations.

- Luna and the Terra Stablecoin may have been rug pulled, wiping out nearly $60 billion USD from the larger cryptocurrency community.

- Celsius stopped users’ withdrawals which was a major red flag, then filed for bankruptcy alongside Voyager.

- FTX was a very dodgy situation and impacted the largest number of people. This debacle put many companies on thin ice.

The common theme of these tragic events for the year was the alternate cryptocurrencies and the trust people had in exchanges to hold their “crypto”. Bitcoin does not generate yield out of thin-air, so any exchange offering “yield services” is re-hypothecating their funds somewhere. Using your funds. Risking your funds.

Unfortunately, Bitcoin gets wrapped up in all the mess of the cryptocurrency space. Despite the negative returns across the year, BTC still performed better than the vast majority of cryptocurrencies. And led to more individuals to lose faith in altcoins, and gambling casinos, that thrived in 2021, and decide to humbly stack sats and hold their own coins in 2022.

Not everything was bad in 2022.

There was so much knowledge spread about Bitcoin all over Twitter. If you want to get a sense of value located there, have a look at this tweet that covers all the best threads of 2022. Some of the important aspects of the year were:

- Shell, the oil industry giant, took steps to move into the Bitcoin mining space.

- Bitcoin experienced all-time lows in price volatility, hushing the ‘Bitcoin is too volatile’ crowd.

- Bitcoin’s sustainable energy usage in BTC mining grew to 59.4%. Higher than any countries’ percentage of energy being created by a sustainable source.

- Bitcoin network continued to grow, with now 43.2M non-zero BTC addresses (an increase of 9% from 2021) and 7 more countries legalising Bitcoin.

There are many more important aspects of Bitcoin that happened over 2022, but people always remember the price. The price action wasn’t great across the year, however, realise that this means cheaper sats. Make a stacking goal for 2023 and try your best to stick with it. In 5 years you’ll realise how important buying Bitcoin today was.

Bitcoin’s value doesn’t equal Bitcoin’s price. If you want to understand Bitcoin’s value have a look at the guide below:

Proof of Keys Day.

January 3rd 2023, marked ‘Proof of Keys’ day in Bitcoin. The same day back in 2009, was historic for Bitcoin – the day Satoshi mined the Genesis Block. Proof of Keys encourages all Bitcoiners to take possession of all their Bitcoin located on exchanges.

AmberApp is an exchange and while we do not re-hypothecate any funds to attempt to generate a yield for your Bitcoin, we recommend that everyone (when they feel comfortable) move their Bitcoin into their own hardware wallet. We’ve even got a guide. If you do decide to hold your Bitcoin on the AmberApp we want you to know we take Bitcoin custody seriously.

You may have heard of talks in the latter half of the year about proof of reserves. Exchanges that will construct a system to show their users that they have all the funds that they claim to have.

We think this still requires trust. It doesn’t verify anything. If you want to verify our funds (which you should do), move your BTC off-exchange. Don’t trust us, don’t trust anyone to store your BTC.

Remember not your keys, not your coins!