It’s 31 December 2012, and Bitcoin’s closing price is USD13.45 — up 145% for the year. It was a big year that included Wikileaks disclosing 5 million emails and other notable events such as Usain Bolt winning the 200-meter sprint at the London Olympics in just 19.32. You’ve likely accumulated a nice nest egg if you bought Bitcoin around this time and hodled your way through the last ten years.

For those of you who’ve only just started or are still considering stacking sats, you may think you’re too late. Here’s the good news: you’re not. One of the things that get people tricked into thinking it’s too late to start stacking sats is unit bias. “Bitcoin is too expensive”, you might hear someone say before they buy some altcoins in the hope that they will experience the same explosive price growth as Bitcoin. The truth is that Bitcoin’s early growth could be nothing, when compared to the potential for further growth ahead.

Of course, no one has a crystal ball to know exactly where the price of Bitcoin (or any other asset for that matter) is headed. The key thing to keep in mind is what Bitcoin’s technology means, how it protects and provides a hedge against a dystopian fiat world, and that 1 Bitcoin always equals 1 Bitcoin. In short, stop comparing Bitcoin to fiat altogether, and you’ll start to see why we’re still so early.

There is no “next Bitcoin”. 🙅

When people decide to buy altcoins instead of Bitcoin, some will say it’s because they’re trying to buy the next Bitcoin. There is no “next Bitcoin”. To put this into context, think of the internet. When it was first invented, only a very small number of people knew how to use this nascent technology to communicate and exchange information.

Since then, the power of communication and information via the internet has spawned social media, vast connectivity via smartphones, eCommerce, the ability to work remotely, and the convenience of streaming the type of video and audio you want when you want (without being subjected to corporate virtue signalling). Bitcoin is like the internet of value. All of the evolutionary technologies we use daily and take for granted were built on top of the internet. They are the Layer 2 solutions. By accumulating Bitcoin, you’re accumulating a piece of the valuable infrastructure on which truly decentralized and trustless technologies are built. This is the future. It will take years, maybe decades, to be fully realised, which is why we’re still so early to Bitcoin.

Bitcoin has Layers, and Now They’re Proven 🔶

To think of Bitcoin in layers helps us to understand the power of the technology:

- Layer One: store of value and settlement

- Layer Two: medium of exchange

- Layer Three: decentralized apps

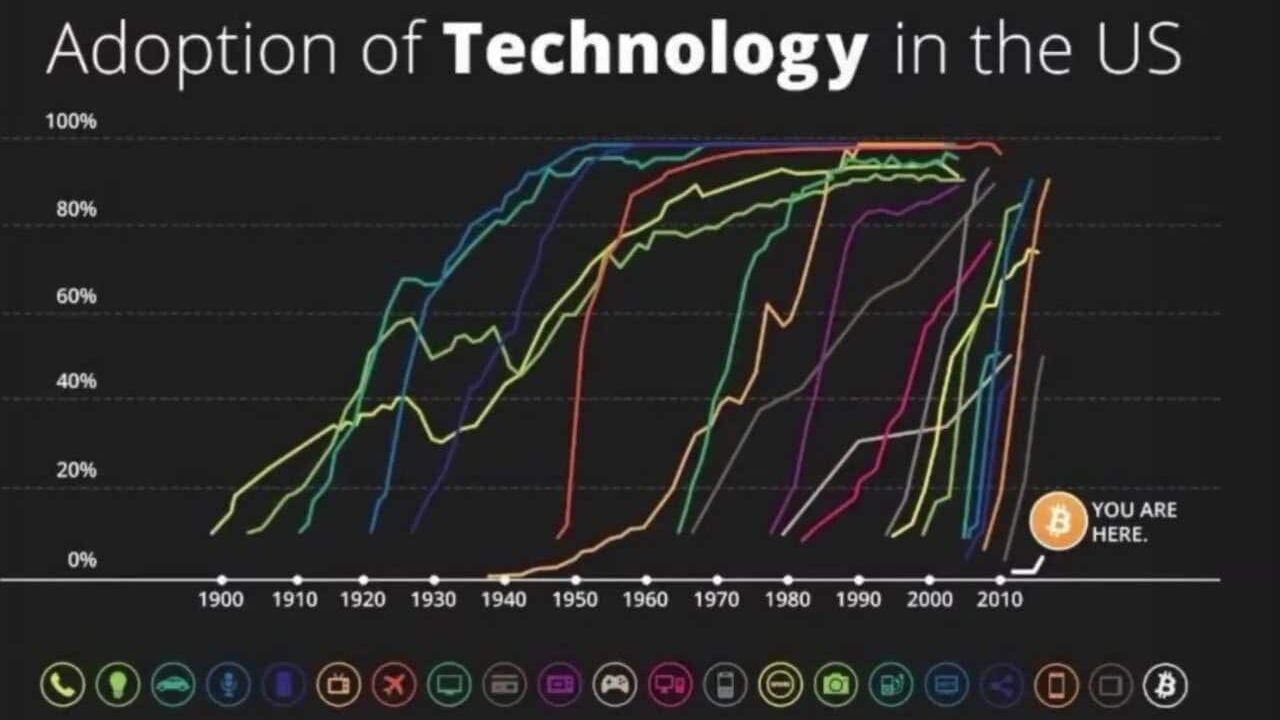

Bitcoin’s Layer 1 technology is known as the settlement layer. This is the layer where people transact. It’s trustless, meaning there’s no need for a third party like a bank, payment processor or government to keep everyone honest. The trustless nature of Bitcoin’s distributed ledger solves the double-spend problem that no cryptocurrency before Bitcoin was able to solve, and other TERRAble (sorry, I had to) attempts at stability since have not been able to solve either. And with nation-states adopting Bitcoin as legal tender, private companies accumulating Bitcoin to hold on their balance sheet, and some companies even moving to operate on a Bitcoin standard, the Layer 1 technology is a proven store of value, both from a security standpoint and as an inflation hedge. Further, Bitcoin has the same amount of users today as the internet did in 1997 – roughly 140 million. As outlined in the chart below, at the current adoption rate, Bitcoin is expected to reach 1 billion users — around 2005 internet user levels — in four years (2026). Compare this to the internet, which took 7.5 years to go from 130 million to 1 billion users.

What do Bitcoin’s Layers Have to Do with Being Early? 🌅

Layer 2 technologies such as the Lightning Network now have over 13000 nodes and, 51000 payment channels globally. These nodes enable people to transact peer-to-peer, fast. Meaning, for those of us who don’t have access to traditional financial services, now you can cheap, easy, and almost instantaneous. If you’re sick of the complication of transacting across borders on legacy channels, you can do it almost instantly with the Lightning Network. Most importantly, these networks aren’t subject to control and censorship by a central authority. Decentralised nodes confirm transactions and keep the network open and honest. These nodes use the network to secure their own financial sovereignty, so it’s in everyone’s interest that things are running honestly. On the (currently) final layer on Bitcoin’s infrastructure known as decentralised apps or Layer 3, people are building technologies that allow others to do things such as communicate, send messages, and even make calls using the Lightning Network and its nodes. It also allows people to monetise products and services without a bank account. Some critics may say this opens up the network to transact in illicit products and services. It might, but there’s plenty of that already in the fiat world. What’s most powerful about these Layer 3 technologies is the ability for someone to earn money without needing a bank account. It rewards those with ingenuity and the desire to bring value to the world and to leave it in a better place than when they found it. How many political leaders are genuinely doing that at the moment?

The levels of innovation and value creation being built on Bitcoin’s infrastructure haven’t been seen since the birth of the internet. Buying Bitcoin now still makes you an early adopter, which could be a potentially life-changing investment of resources both in learning about the technology, understanding what money is, and hodling onto a secure and private store of value.

Keep Calm, Stack Sats and Extend your Time Horizon 🕰

To worry about Bitcoin’s price today is like worrying about tech stock prices after the global financial crisis —it lacks critical perspective. Even old-school value investors, and staunch critics of Bitcoin, like Warren Buffet, recommend people invest with a long time horizon. Bitcoin is no different, only you’re getting in early on the opportunity to own part of something that has the potential to completely revolutionise how the world operates, interacts, and exchanges value. With a long time horizon, you don’t need to worry about the day-to-day price of Bitcoin. You certainly don’t sell when there’s a dip. If you did the same with long-term stock investing, you’d be foolish too.

To begin (or continue) accumulating your piece of the infrastructure that’s still in the early stages of changing our world, shift your thinking from fiat currency value to the number of sats you want to stack. We have to compare oranges to oranges, after all. Here’s how this shift might look:

- Don’t stack $1,000 worth of Bitcoin.

- Stack 5,000,000 sats (0.05 BTC).

Shifting your thinking in this way creates the necessary distance between you and a fiat currency system that, frankly, has never really delivered any meaningful form of long-term value to anyone.

Start stacking today and you can thank yourself tomorrow that you were still so early.

Do you want to learn more about how you can use Bitcoin as a store of value and hedge against legacy financial and economic systems? AmberApp makes it easy for you to start sacking sats in minutes.

If you’re ready to get started, download AmberApp to make your first Bitcoin purchase in under 90 seconds.