It’s been 10+ years, but Bitcoin’s still going strong. For some – the cryptocurrency is a novel transaction method either in a sanctioned market or otherwise. To others, it’s money in its most quintessential form: an asset more scarce and more easily transmitted than gold, whilst more divisible, portable, durable & functional than any fiat currency we’ve ever had.

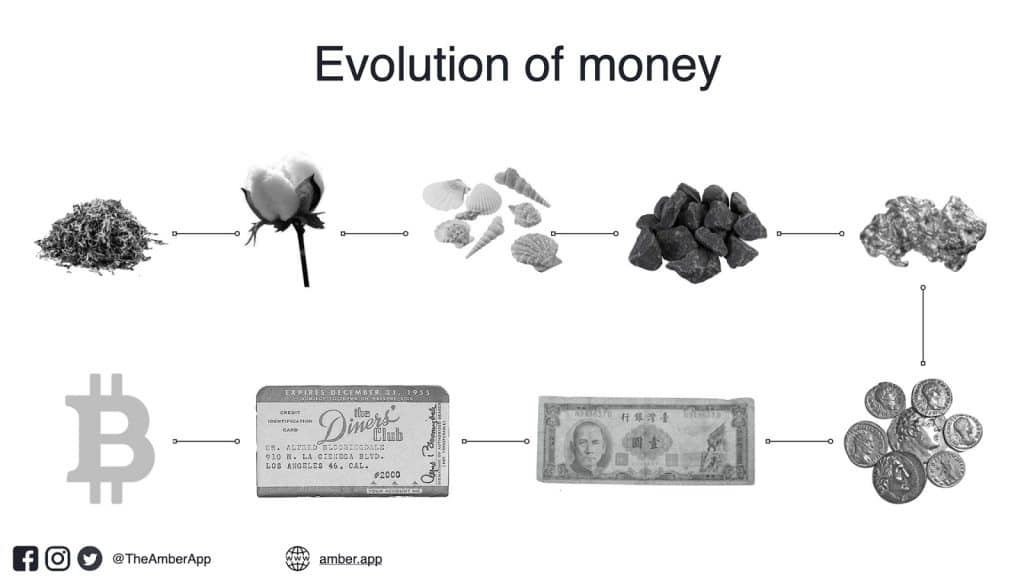

The evolution of money

In very simple terms:

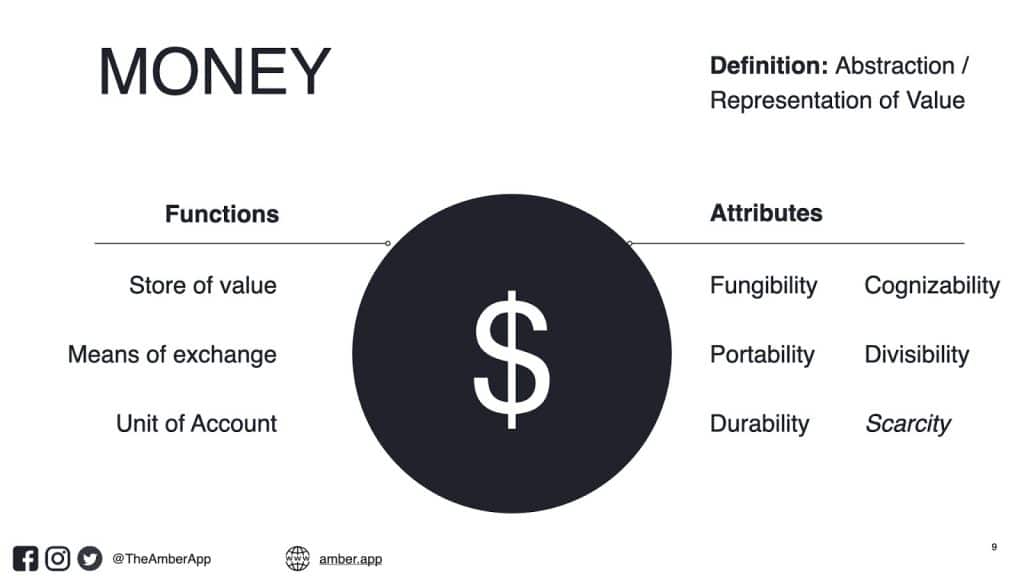

- Money is the cornerstone of all civilisation. It’s how we subjectively measure our individual inputs into society, or in other words, the “product of our labour”.

It’s the fabric that binds us. It enables us to cooperate both at scale and in greater degrees of complexity.

Money always exists, the only thing that changes is what we use as money; and that’s evolved over time.

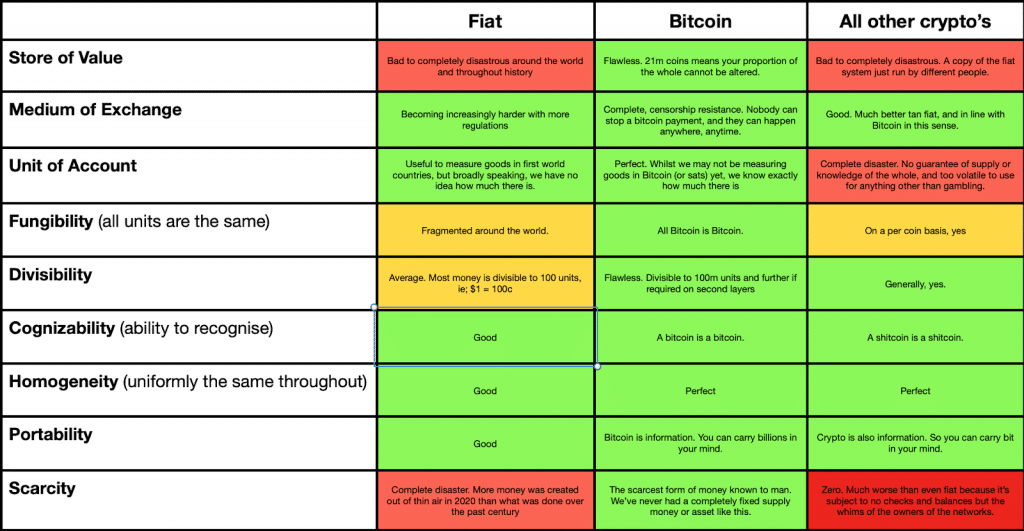

- Bitcoin is superior to all other forms of money because it perfectly embodies every attribute, and it’s open source, always on, fixed supply, digital nature means that it performs the functions of money flawlessly.

- More people are realising that the product of their labour (ie; their wealth, their savings & their money) are all constantly eroding and diminishing in value. More people, from all around the world, whether rich or poor are going to seek to store their wealth in something that cannot be diluted. This is a powerful movement and one that’s not going to reverse. In the same way you would not work all your life and have your life savings in salt, future generations will look back on us today and wonder how in the name sanity did we believe that measuring our wealth in a currency or money that devalued over time ever made sense.

As more people come to understand what money is, how it works, what it represents and what the primary attributes of money are, they want to ensure they are holding their wealth in a form of Money that has the best possible attributes as a store of value, a unit of account and as a medium of exchange.

It just so happens Bitcoin scores highest for all of these functions and across all of the necessary “attributes of money”.

If you’d like to learn more about the basics of money, how it evolved over time and why Bitcoin represents the apex money, the following articles discusses it in more depth:

What makes Bitcoin valuable?

Bitcoin is a “fixed supply” asset, meaning that there is a known and unchangeable total number of Bitcoin that will ever be in existence.

That number is 21 million, and if divided to its basic denomination (Satoshis are the Bitcoin equivalent to the cents in dollars), there are 2,100,000,000,000,000 units in total.

Why is Bitcoin rising so fast today?

Well, there is both a simple answer and a more complex answer to this question.

Simply speaking, the demand for holding Bitcoin is outstripping the total available supply. As demand increases, and the supply stays constant, the only parameters that can budge are what the buyer is willing to pay for it, and conversely, what the seller is willing to sell it for, in other words; the price.

So the simple answer really can be summed up with the following equation:

If demand is more than supply, then the price increases .

And this has been the story of Bitcoin since the beginning.

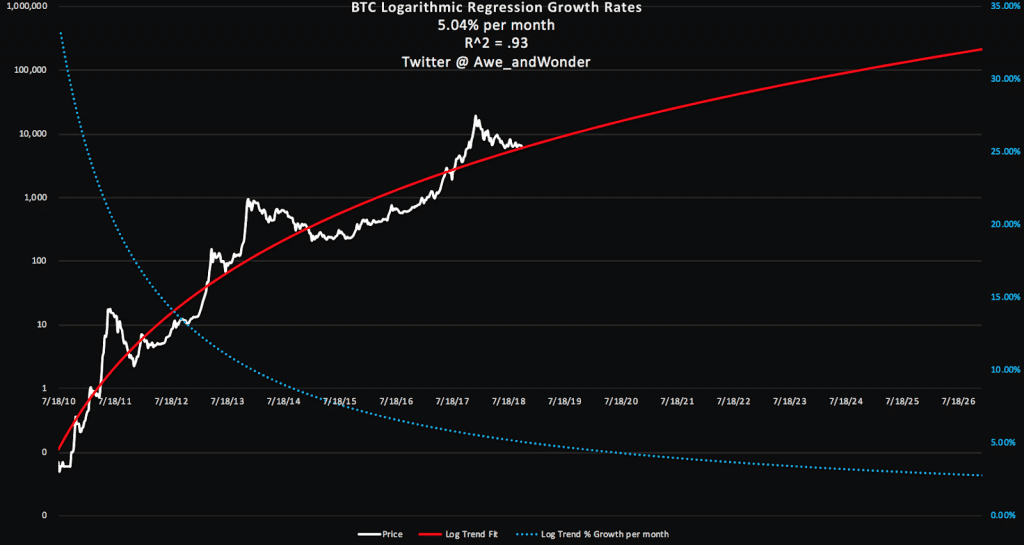

Every cycle, it grows by an order of magnitude (see figure 2 below).

Up over 100,000,000 % since inception, with a compounded ROI of more than 500% per annum, it’s showing no sign of slowing down, particularly when we find that barely a few percent of the world population actually hold any meaningful amount of Bitcoin.

Fig 2.0 – Bitcoin Price History Chart

So why is this happening? Well let’s look at the more in-depth answer to the question of “why is Bitcoin rising in price so fast?”

Firstly, we’ll need to define a few concepts. Once we do, we can better answer the core question;

Why is the demand for Bitcoin outstripping its supply?

Because that’s really the question we’re asking when we think about ‘why the price is rising so fast’?.

As noted earlier, the point where the buyer meets the seller is known as the “price”. This applies to anything from apples, to shoes to cars, houses and of course to Bitcoin.

Bitcoin (I’m speaking here about the Bitcoin token, not the Bitcoin network itself) is an organically priced instrument, meaning nobody “dictates” what the price should be. It’s converged upon as buyers meet sellers in marketplaces around the world agreeing to trade today’s dollars for Bitcoin, and vice-versa.

This price has fluctuated since day one, which is perfectly natural for anything we buy & sell, and more-so for a new phenomenon like Bitcoin because nobody really knows how to accurately value a form of money that’s immune to confiscation, censorship and inflation.

And this is perfectly fine, because in free markets, we all individually and subjectively discover its value for ourselves. In time we converge on a broadly accepted value which fluctuates less because it has a larger total mass.

Gold is a great example. It took roughly 5000 years to perform this process and to this day it’s still something that despite its use over millennia, is and will remain subjectively valued.

How is the Bitcoin price rising, didn’t Bitcoin die?

The first time it was “valued” in the marketplace was when Martti Malmi traded 5000 bitcoin for $5, giving it a value of $0.001c.

The next time was when Laszlo Hanyecz swapped 10,000 bitcoin for 2 Pizzas. An 800% increase in price to $0.008c.

Since then we’ve seen Bitcoin grow in waves, from practically $0 to $1, then to $13, only to come back to the low single digits. It took some time for initial markets to emerge and for Bitcoin’s raison d’etre to be noticed by more people (a trend that continues today).

We saw this growing adoption of a new “global money of the internet” drive the price to approximately $130, in what some would claim was the first “Bitcoin bubble”, only to once again correct and retrace to the lower double digits.

The next “cycle” saw it grow to over $1300 per Bitcoin, only to have buyers panic & sellers take profit, sending the price back to the mid $200’s.

Again, everyone who didn’t take the time to understand bitcoin, nor monetary history, claimed that “Bitcon is dead”:

From Bitcoin Obituaries; a brilliant site chronicling all the times Bitcoin has been announced “dead”.

Barely 4yrs after what many called “the end of Bitcoin (again)”, we saw buyers and sellers subjectively but collectively drive the price to almost $20,000 USD; the highest a bitcoin has been worth, to date.

This was 2017, and is the first time, although certainly not the last, that Bitcoin really entered the ‘mainstream’.

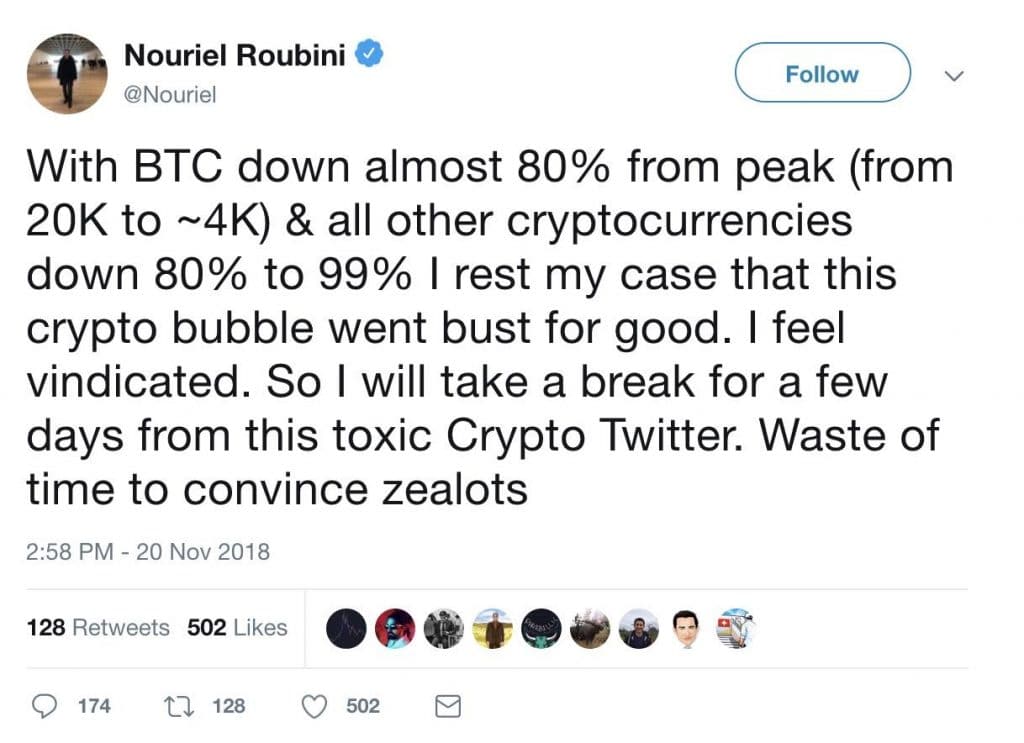

Of course, this cycle saw the so-called “Bitcoin bubble” pop once again, and like clockwork, the naysayers came out to hurl abuse at something they continually fail to understand.

So why did the Bitcoin bubble pop, and is the Bitcoin bubble over?

Let’s apply some logic alongside what we’ve learned above.

All markets are cyclical, and nothing in the world moves in a straight line. Remember that price is simply a representation of the point at which a buyer and seller are willing to meet & trade a good.

There were droves of people in 2017 who took no time to understand why they were buying Bitcoin, except that their cousin’s cousin’s friend’s mum said it’s a good idea.

Not the best advice to make any form of financial decision from.

So of course, these same people ‘FOMO’d in’ on the way up as they and then continued to freak out when the price pulled back and they sold on the way down at a loss.

Despite how crazy it may seem from the outside, this is perfectly normal herd behaviour and is exacerbated in the Bitcoin market because it’s so young (it was barely a decade old at that point).

And moreover, this is all a part of bitcoin’s natural evolution. It has to come into being somehow, and that will not happen by some “executive order”, but through natural emergence in the market.

Growth naturally comes with volatility, and therein lies the opportunity.

Stability will certainly come as Bitcoin’s total market capitalization increases, but the trade-off is the opportunity cost of acquiring some now (cheaply) before the rest of the world catches up and demands to hold their share of the most powerful money & store of value that exists.

Think of it like discovering Gold while the rest of the world was still using shells, rocks & salt as money.

You would’ve likely been seen as a crazy person to begin with, but if you were able to somehow live a few thousand years and watch the world converge on Gold as a way to best represent the product of their labour, you would’ve been rewarded for your early find.

This is where we are now with Bitcoin, but in a digital, interconnected age where millennia of historic change occurs in decades.

Where can you learn more and easily get involved?

Bitcoin is a fundamental step change in how money works. To quote Peter Thiel; it’s a Zero to One innovation.

The demand to hold this kind of money will only continue to grow, whilst the supply stays strictly fixed.

As at time of writing this (November 2020), the current price of Bitcoin is almost $17,000 USD again, which is just shy of $24,000 Australian dollars. Barely 3yrs since the peak of the last cycle, here we are again, about to cross the previous high and as a herd begin to drive Bitcoin to a new high.

What will Bitcoin be worth by 2025? It’s anybody’s guess.

I personally believe it will be far in excess of what it is today.

At least 10x today’s price, and most likely gearing up for the next cycle and on it’s way to the big $1m USD per Bitcoin milestone, which would price each satoshi at 1c.

We are still so early. The right time to bitcoin is always today, and the only time it was more right was yesterday.

When people ask me: “is it too late to buy bitcoin in 2020”, all I can say is; was it too late for you to get an email address or buy a web domain in the early 1990s?

If you’re living in Australia and want to know how to buy Bitcoin in Australia, we’ve got ample resources in our learning hub. Be sure to read our free Guide to Investing in Bitcoin. Despite being a 2019 edition, it’s as relevant now as it was then – and probably more so. Also, you can check out our 7-step beginner’s guide to buying Bitcoin in Australia – written in 2021.

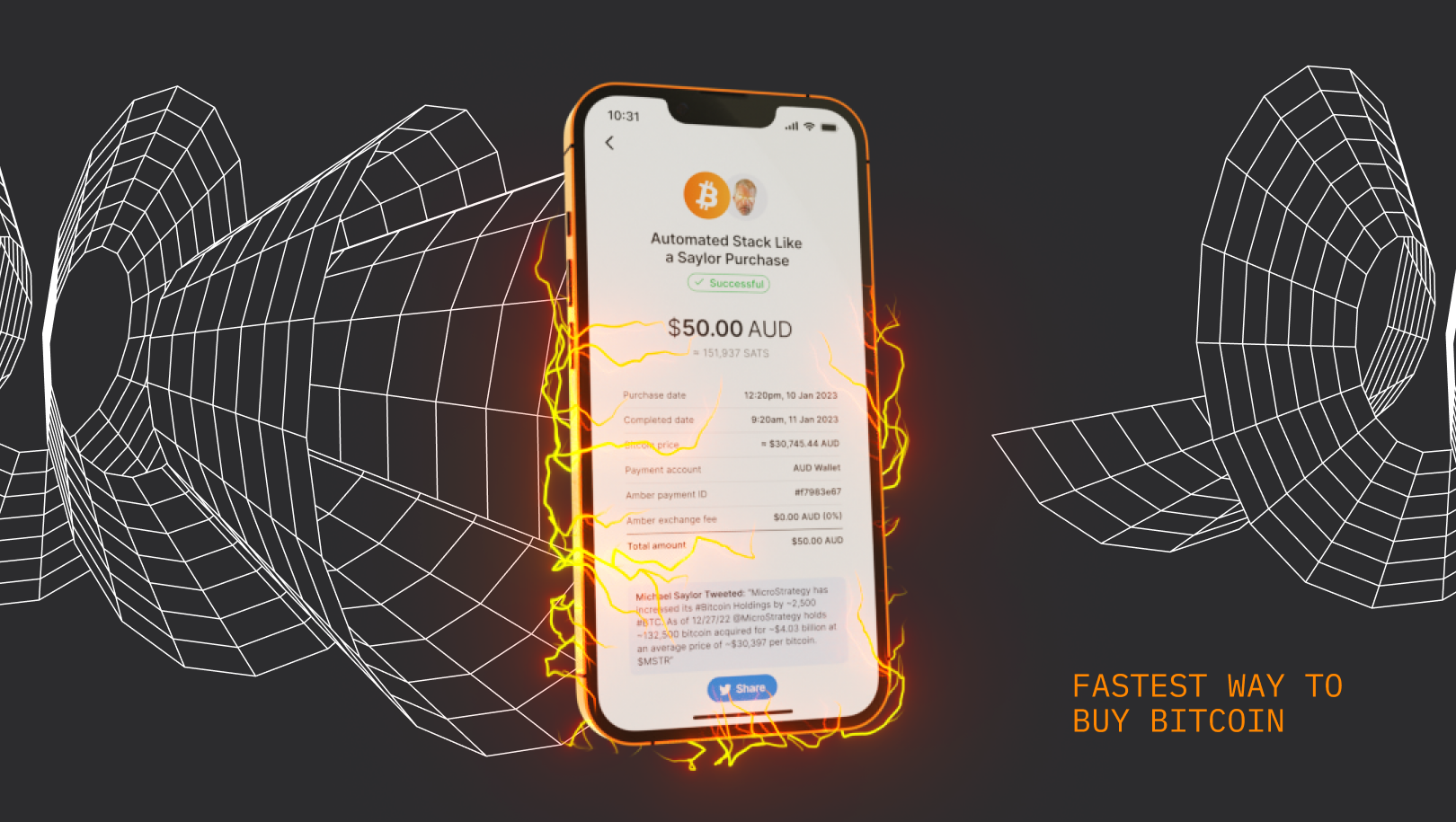

If you’re ready to get started and want to know where to buy Bitcoin, we truly believe that we’ve built the best Bitcoin accumulation product in the world – and if you’re in Australia, that means you’re one of the lucky ones that can use it.

Whether you’re looking for the lowest fees, intelligent automations, the quickest & simplest set up, the smoothest experience, multiple funding options, credit card, direct debit, PayID, Apple Pay, Google Pay or EFT, AmberApp has it all.

It’s designed for you to set & forget, whilst you accumulate the world’s fastest growing asset and scarcest money.

(This article was originally written by Matt ฿ in July 2019, updated in Nov 2020, and re-published in Jan 2021.)