Q: What is Bitcoin; an investment or a money?

A: Both.

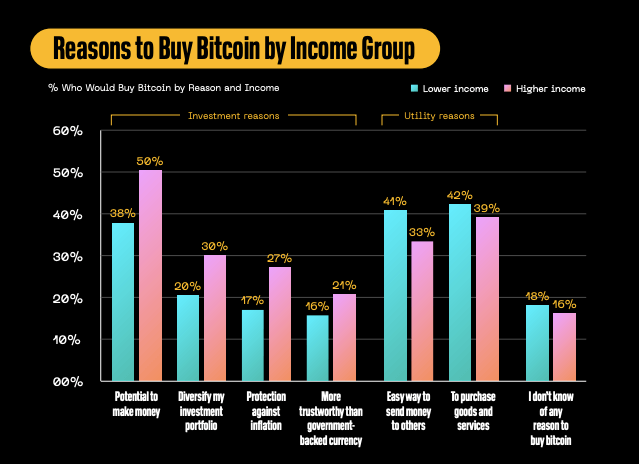

Bitcoin doesn’t have just one strength – but many. This ‘fix-all’ approach by Bitcoin allows different individuals to be attracted to different aspects of Bitcoin. Where you live, and what your current financial situation is, plays a massive part on how you view Bitcoin. The new Block Inc. Report displays just that, with the lower income group clearly buying Bitcoin for its utility value. Whereas, the higher income group looks at Bitcoin as both an investment and a currency.

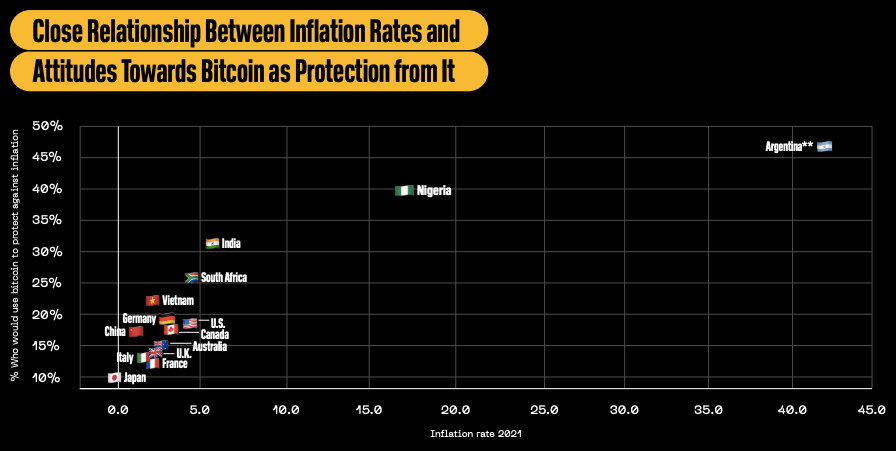

Despite the results of this report, it’s still hard for an individual in a country like Australia to use Bitcoin to purchase goods or services. Since, BTC as a form of payment is only accepted by a limited number of stores. What wasn’t highlighted on the report, within the utility reasons, was the ability to be “banked” with Bitcoin. Many people in developing nations don’t have access to a bank account, which is a massive issue. More than 2.5 billion people have no access to a bank account across the globe. These nations do not have the advanced monetary rail systems of Australia or the United States. Which is why Bitcoin can help revolutionise the financial status of many. This is what’s happening in El Salvador, with 70% of the unbanked, now adopting a Bitcoin wallet. In El Salvador, Bitcoin is hope. Bitcoin & Inflation It’s hard for people that haven’t experienced hyper-inflation to understand how important the promise of “freedom money” is. Bitcoin removes the money from the state. Citizens of Venezuela have watched their money debase until it’s become completely worthless; through no fault of their own. The Block Inc. Report showed the relationship between those who are challenged by reckless inflation and their appreciation for Bitcoin. Nigeria’s Bitcoin adoption is paving the way for other African nations. And Argentinians are trusting “mathematics and software more than politicians”. For these people, Bitcoin is an inflation hedge, regardless of what main steam media says.

What’s the correct view? Depending on who you listen to in the Bitcoin space, you may get slightly different answers on what role Bitcoin plays. One of the more clear distinctions between the views on BTC is that of Jack Mallers & Michael Saylor. Michael Saylor approaches Bitcoin, with the “never sell” mentality. Clearly, seeing it as an investment opportunity. With a near infinite upside. Jack Mallers, on the other hand, adopts a more utility focused view of Bitcoin. As someone, who is deeply involved in Bitcoin’s layer-2 Lightning Network. Mallers sees Bitcoin more as a railroad to help payment systems around the world. Moving people from the traditional way of sending and receiving money, to a faster, cheaper and more secure way – on Bitcoin. The distinction between utility and investment can also be made between Satoshi’s original vision and Hal Finney’s early claims. With Satoshi supposedly seeing Bitcoin in the same light as Jack Mallers, as a “peer-to-peer electronic cash system”.

Leading some people to claim that HODLers are disrupting Satoshi’s supposed premise of Bitcoin. The late Hal Finney made extremely early remarks on how an investment into Bitcoin would reap remarkable rewards. An investment today, for the future – tomorrow. Critics of Bitcoin love to highlight these differences as a weakness of Bitcoin. However, they fail to mention that money is made up of three aspects:A Store of Value (SoV)A Medium of Exchange (MoE)A Unit of Account (UoA)Any claim that Bitcoin is either a great investment or a newfound money, is irrelevant. It can be both and more. Follow us on Instagram as we post a glossary of important Bitcoin terms over the coming month. If you see Bitcoin as only an investment today, being appreciative of the utility value should only confirm your decision to HODL Bitcoin. Bitcoin is both the evolution of money and the revolution.